This post includes an excerpt from the Q4 2017 Forisk Research Quarterly feature article, “Local Projections and Pricing Impacts of Timber Supplies in the U.S. South” authored by Amanda Lang, Shawn Baker, and Brooks Mendell

Each year, Forisk estimates future changes in forest inventories by product and specie in the South. This exercise combines state-by-state analysis of wood demand, forest industry capacity and capital investments by Forisk with current forest supply data from the U.S. Forest Service and modeling by Dr. Bob Abt with SOFAC. The analysis of timber supplies and wood demand matches the location of wood sources to forest industry manufacturers. The results tell different stories by state – or group of states – across the region.

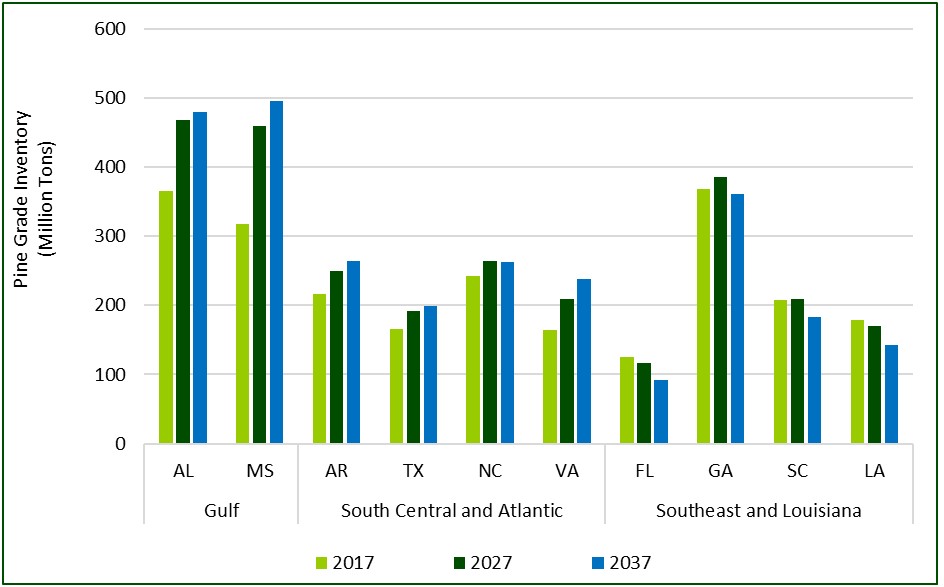

Grouping states based on similar trends can identify opportunities and support capital allocation decisions. For private pine inventories in the South, states group into three pine inventory profiles based on our 30-year projections. The groupings are roughly geographic, with the Gulf States of Alabama and Mississippi performing similarly, and the southeastern states of Georgia, Florida, and South Carolina form a group. Despite their geographic separation, the South Central states and Atlantic states of North Carolina and Virginia have similar projected inventory patterns to each other.

Sawtimber inventories increase substantially in the Gulf States by 30-40% in the next ten years, stabilizing in fifteen years (Figure 1). The South Central and Atlantic states grow sawtimber more moderately, with 10-year increases that average 17%. Sawtimber forecasts for the Southeastern states and Louisiana are stable to declining over the 20-year projection.

These forecasts indicate tighter pine sawtimber supplies in the Southeast (Florida, Georgia, South Carolina) and Louisiana. We would expect some ease to the sawtimber overhang downward pressure on timber prices in these areas in the mid-term, which is favorable for timberland investors. In contrast, the Gulf South areas of Alabama and Mississippi show large surpluses of pine sawtimber that continue in the foreseeable future. These supplies represent an opportunity for mill investors and are already attracting manufacturers, with the announcement of GP’s planned new mill in Talladega and Interfor’s announcement of a greenfield mill somewhere in the mid-South in the next two years.

Today, the South has five more years of pine sawtimber inventory on the stump relative to annual removals than before the recession. The recession reset the “normal” relationship of supplies to removals in the South. Returning to pre-recession levels of inventory to removals requires Southern softwood lumber production to increase 50% beyond Forisk projections, from 23 BBFT in five years to 35 BBFT of annual production. This would be roughly equivalent to the current lumber production of the entire U.S. The true stories for timberland owners and wood-using firms reveal themselves locally. The balance of supply and demand varies by market, with some already demonstrating responsive prices while others require the hard work of building up wood-using capacity to absorb and leverage the accumulated supplies.

Forisk thanks Dr. Bob Abt with SOFAC for his assistance with this research.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

“Returning to pre-recession levels of inventory to removals requires Southern softwood lumber production to increase 50% beyond Forisk projections, from 23 BBFT in five years to 35 BBFT of annual production.”

or … dramatic increase in log exports out of the Southeast

think …

Very recent Panama Canal expansion

China’s $350 B trade deficit

Trump’s demand of Xi to close that deficit by $200 B, NOW

$WY sinking major bucks into a deep south Timber export facility (listen to most recent quarterly earnings conference call.)

And, suddenly, SE stump backlog is GONE.

Its a freshman mistake to be making predictions about US Timber supply/demand right now, until we get firm direction from Xi.