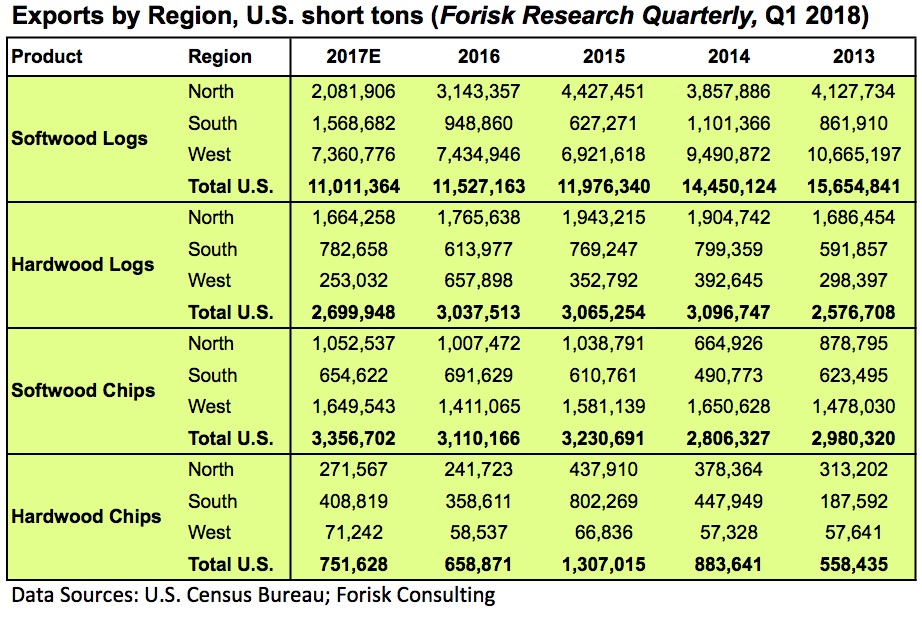

Summary: Exports of softwood logs from the U.S. were on pace to decline for the fourth consecutive year, and hardwood logs expect to decrease a third consecutive year. U.S. softwood log exports were down 5.2% year-over-year through November 2017, while U.S hardwood log exports dropped 11.4%. U.S. log exports to Canada were down 27.9% year-over-year, yet Canada remains the second largest importer of U.S. roundwood with 20.7% of the total volume. Hardwood chip exports were up 9.0% relative to this period last year, while softwood chips increased 7.4%. Red oak, maple, and ash accounted for 64.6% of total U.S. hardwood logs exports.

Southern softwood log exports increased 64.4% year-over-year through November and are on pace to surpass 1.5 million tons in 2017, the highest level in over 25 years. Hardwood log exports from the South were up 24.8% over this same period. Despite the regional gains of the U.S. South, total U.S. exports of softwood logs are on pace to decline for the fourth consecutive year. As a percent of total U.S. softwood log exports, the South, at 14.2%, has the smallest market share. The West leads this sector with 66.8% of total softwood log exports through November 2017, while the North accounted for 18.9%.

China remains the largest importer of U.S. softwood and hardwood logs and is increasing its market share in both products. Canada remains the second largest importer of U.S. roundwood, though volumes have declined. Japan was the second largest importer of U.S. softwood logs through November 2017. If this trend holds, it will be the first time since 1999 that Japan imported more than Canada.

Both softwood and hardwood chips tracked higher, relative to their volume a year ago. While U.S. hardwood chip exports were higher in all regions, increases in softwood chip exports were driven by the West, which projected to surpass 1.6 million tons in 2017. Softwood chip volumes from the U.S. South were down 7.6% year-over-year; regionally it has the smallest market share with 19.5%. The West leads with 49.1%, followed by the North with 31.4%. Japan remains the largest importer of U.S. softwood chips, a position it has held since 2014.

Andrew Copley leads Forisk’s tracking and analysis of North American imports and exports. Each quarter, subscribers to the Forisk Research Quarterly (FRQ) receive industry analysis and market forecasts through 2027 for timber prices, logging costs, softwood lumber production, structural panels production, paper and paperboard production, forest supplies and ownership, and wood bioenergy markets. To learn more about the FRQ, click here or call Forisk at 770.725.8447.

Leave a Reply