This is the first in a series related to Forisk’s Q2 2018 forest industry analysis and timber price forecasts for the United States and Canada.

When forecasting timber prices and delivered wood costs, we work to (1) identify relationships in historical data and (2) understand the “physical facts” on the ground in local markets related to forest supplies and manufacturing capacity. From here, we infer future conditions and take positions on results moving forward. Part of “inferring future conditions” requires framing different economic scenarios that include a baseline outlook for housing markets.

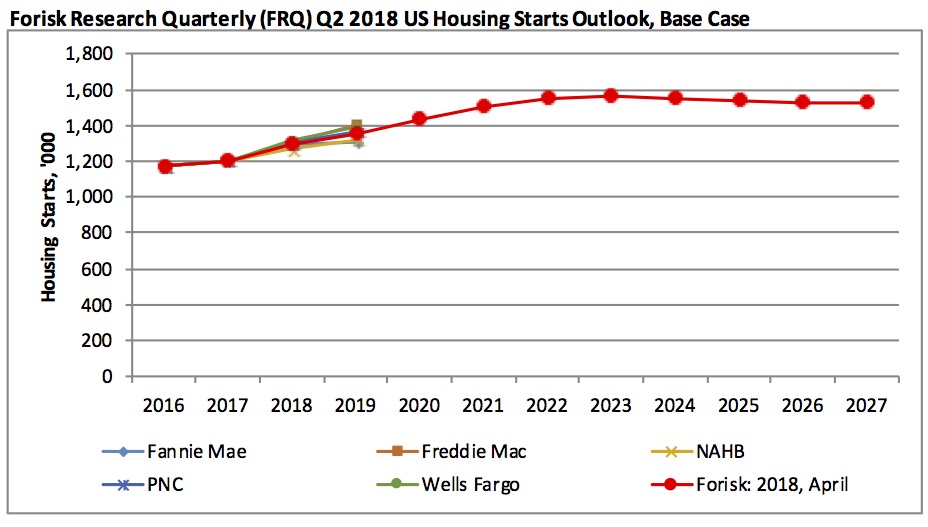

Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Freddie Mac, the National Association of Home Builders (NAHB), PNC, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Overall, Forisk projects 2018 housing starts of 1.29 million, up 7.5% from 2017 actuals. Forisk’s 2018 Base Case peaks at 1.56 million housing starts in 2023 before returning to a long-term trend approaching 1.53 million. For comparison, our January 2018 Base Case last quarter estimated 1.28 million starts for 2018 with a peak of 1.57 million housing starts in 2024. The independent housing forecasts captured in Forisk’s Housing Starts Outlook reflect a range of expectations for 2018. For example, Wells Fargo leads with a 2018 forecast of 1.31 million, while the National Association of Home Builders (NAHB) trails with its most recent forecast of 1.27 million.

In addition to the Base Case, Forisk applies a “Slow” Case scenario in the FRQ models to test the implications of less growth and lower levels of housing starts on forest industry production and timber prices. The Slow Case assumes annual housing starts change at 50% of the Base Case. This results in 1.25 million starts for 2018. Overall, the Slow Case projects, on average over the next ten years, 10% fewer starts than the Base Case.

Forisk analyst Andrew Copley supported the research for this post. To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply