This is the third in a series related to Forisk’s Q2 2018 forest industry analysis and timber price forecasts for the United States and Canada. The post includes an excerpt from the Timberland Investment chapter.

The North American timberland market continues to warm up. From Q2 2017 through Q1 2018, we tracked over 2.1 million acres of completed timberland transactions exceeding 1,000 acres in size. Of this total, 1.8 million acres occurred in deals exceeding 20,000 acres each. Regionally, most of the volume in acres (52%) occurred in the South. The North and West split the remainder, at about 24% each. TIMOs accounted for 34% of the total acres sold, followed by timber REITs at 27%. On the other side of the table, TIMOs accounted for 47% of total acres acquired over the past twelve months, followed by (non-REIT) forest industry firms at 37%.

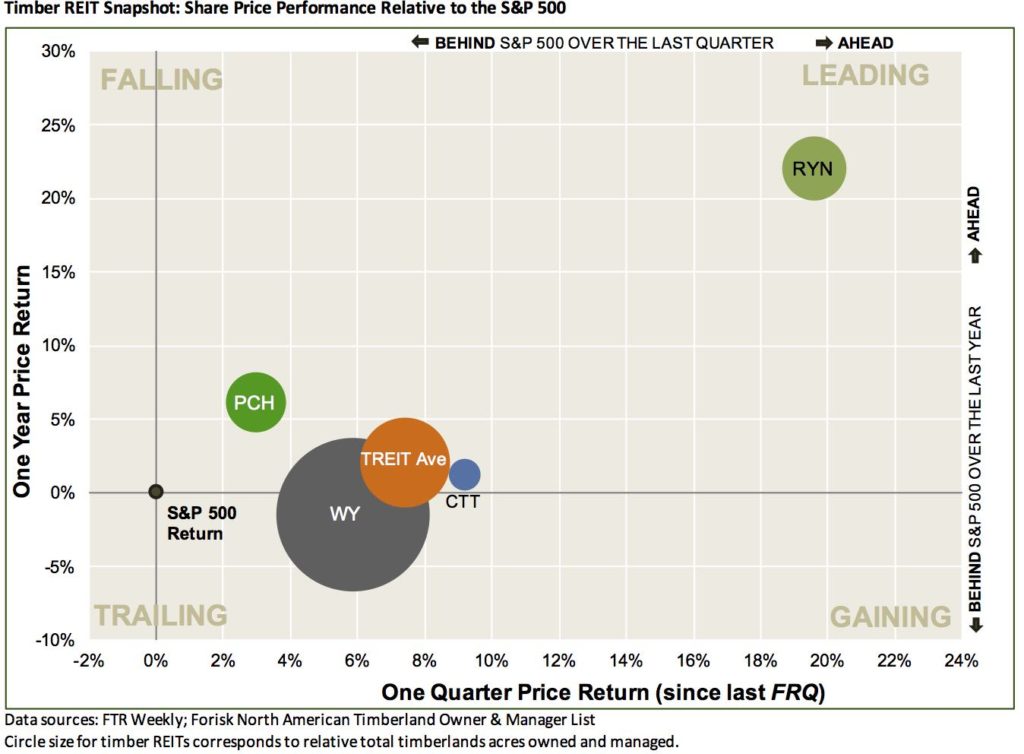

For timber REITs, Rayonier (RYN) led the sector and S&P 500 over the past year and over the past quarter. CatchMark Timber Trust (CTT) and PotlatchDeltic (PCH) also outperformed the S&P 500 over those periods. The figure summarizes the performance of timber REIT share prices relative to each other and to the S&P 500 over the past year (since the Q2 2017 FRQ) and over the past quarter (since the Q1 2018 FRQ). The sector leading performance by RYN includes a positive market response to continued improvement year-over-year in revenues and net income, even accounting for large timberland transactions. While all four public timber REITs (and the S&P 500) exhibited strong, double-digit positive returns over the twelve months prior to January, the past quarter includes rebalancing as equity markets slowed and interest rates rose.

It would be interesting to see how TREITs have performed since the financial crisis vs. the S&P 500.