This is the sixth in a series related to Forisk’s Q2 2018 forest industry analysis and timber price forecasts for the United States and Canada. The post includes an excerpt from the bioenergy research, authored by Andrew Copley and Amanda Lang.

As new demand for industrial wood pellets in Europe has begun to slow, growth prospects have shifted to Asia. As with Europe, demand remains policy driven for both South Korea and Japan; however, policies relating to pellet demand differ in each country.

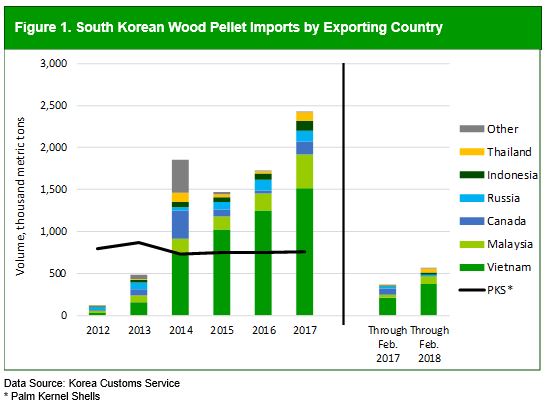

As a result of South Korea’s Renewable Portfolio Standard (RPS), the country has increased biomass consumption since 2012. Wood pellet imports increased from 122 thousand metric tons in 2012 to 2.4 million metric tons in 2017 (Figure 1). Imports from SE Asia represented 88% of imported volumes in 2017; Vietnam was the largest exporter with 62% of the market share. While the U.S. was less than 1% of imported volumes in 2017, Canadian wood pellets accounted for 6% or 152 thousand metric tons. Through February 2018, South Korean wood pellet imports were up 55% relative to this period last year. Over 96% of the 565 thousand metric tons of imports were attributable to SE Asian exporters. Imports of Palm Kernel Shell (PKS)—a substitute of wood pellets, depending on the combustion capabilities of a power plant—have remained stable.

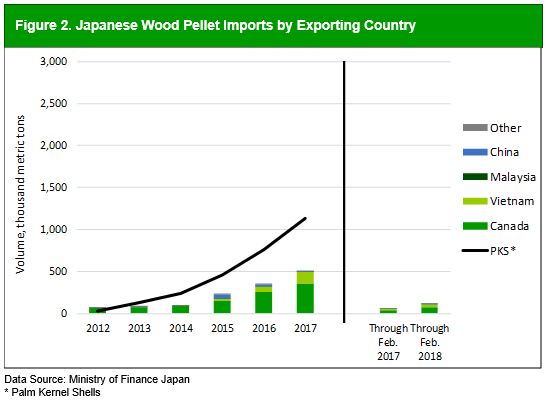

Japan also instituted a subsidy for biomass in 2012, opting for a feed-in-tariff. Given the nature of government incentives, PKS has become a major component of the biomass portfolio in Japan. PKS imports increased from 26 thousand metric tons to 1.1 million metric tons in 2017.

Japan imported 506 thousand metric tons of wood pellets in 2017, a 46% increase over the previous year (Figure 2). Canada remains the largest supplier of wood pellets to the Japanese market, a position it has held since 2012, representing 71% of 2017 volumes. Vietnam, the second largest exporter to Japan, doubled its wood pellet exports in 2017; the 131 thousand metric tons represented 26% of total volume. To date the U.S. has not shipped material volume to Japan. This is expected to change, however. The largest U.S. pellet producer, Enviva, sent its first shipment to Japan in March of this year. The company also recently announced a 10-year long-term off-take contract to supply a Japanese power plant with 100 thousand metric tons annually beginning in 2022. Through February 2018, Japanese wood pellet imports were up 85% year-over-year, reaching 115 thousand metric tons.

Leave a Reply