This is the fifth in a series related to Forisk’s Q3 2018 forest industry analysis and timber price forecasts for the United States and Canada.

Almost everything I hear about logging these days relates to trucking and the challenges of finding and keeping drivers. Even in a major motion picture that features a logger as the action hero (!), I can’t help but feel sorry for the protagonist (portrayed by Aquaman himself, Jason Momoa) because he loses a truck driver to a corrupt drug boss. In tough times, you need every able-boded employee you can get. Given all the furor over trucking, it is still important to ground our perspective in facts. Just how tenuous is the trucking situation? Is the transportation sector really balanced on the head of a pin or is this just our penchant for hyperbole run amok?

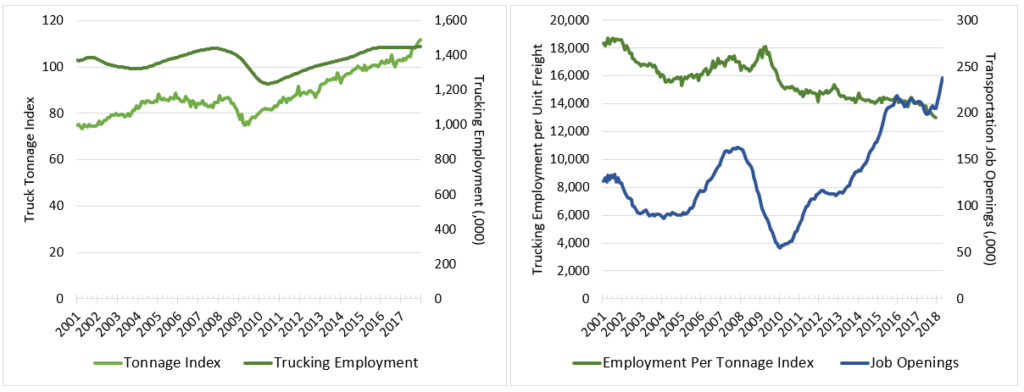

The Bureau of Transportation Statistics truck tonnage index provides a measure of freight volumes being moved by truck based on the American Trucking Associations’ monthly data. The index, now at all time highs, suggests we move as much freight by truck as we ever have. Interestingly, Bureau of Labor Statistics data on the number of people employed in trucking have not kept pace. Employment rose sharply through 2015 but leveled off the last two years. For perspective, the number of trucking employees per unit of freight moved has fallen. The average number of employees per unit of freight varied between 16,000 and 19,000 pre-recession and dropped below 14,000 post-recession. Currently it’s below 13,000. At the same time, the average number of job openings in transportation are rising, jumping appreciably in early 2018.

Employment and job openings in trucking and transportation and an index of total freight moved by truck. Sources: BLS, BTS

Employment is a 12-month moving average of general and specialized freight trucking employees. Job openings are for “transportation, warehousing, and utilities” industry.

A driver shortage makes it more challenging to move freight, and it raises costs. Higher freight rates get paid simply due to demand outpacing supply, but wages are also raised to attract new employees. Salary hikes in trucking directly affect loggers who must pay higher salaries to retain their drivers. Between 2012 and 2017, average annual pay for all employees in the private sector increased at a compound annual growth rate of about 2.4%. Average salaries of log truck drivers in the South increased 3.8% per year and Western drivers saw pay increases of 3.2% over the same timeframe. An annual survey of trucking firms by the American Transportation Research Institute reported the average cost of driver wages per hour increased nearly 6% per year between 2012 and 2016.

How does this affect our view on trucking and the wood supply chain? Forisk forecasts regional hauling costs as a portion of our delivered cost forecasts each quarter. Shortages in the trucking industry show no sign of slowing down in the near term, so we’ve built in additional cost growth in trucking labor over the next five years. We’ll continue to track developments in trucking, and should some new innovation come along to transform our view on where the industry is headed, we’ll adjust course.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply