In reading about the pulp and paper industry, so much news focuses on the declines in printing and writing paper and newsprint. True, North American paper and paperboard production declined 25% since the start of the 2000’s, but the industry still has the capacity to use over 300 million tons of wood annually. Pulp and paper remains a massive and important industry. Different paper sectors have experienced divergent fortunes, with packaging and household paper far more resilient than newsprint and printing and writing papers. Much of the activity in the paper sector is in conversions to packaging, tissue or fluff pulp to service those thriving markets.

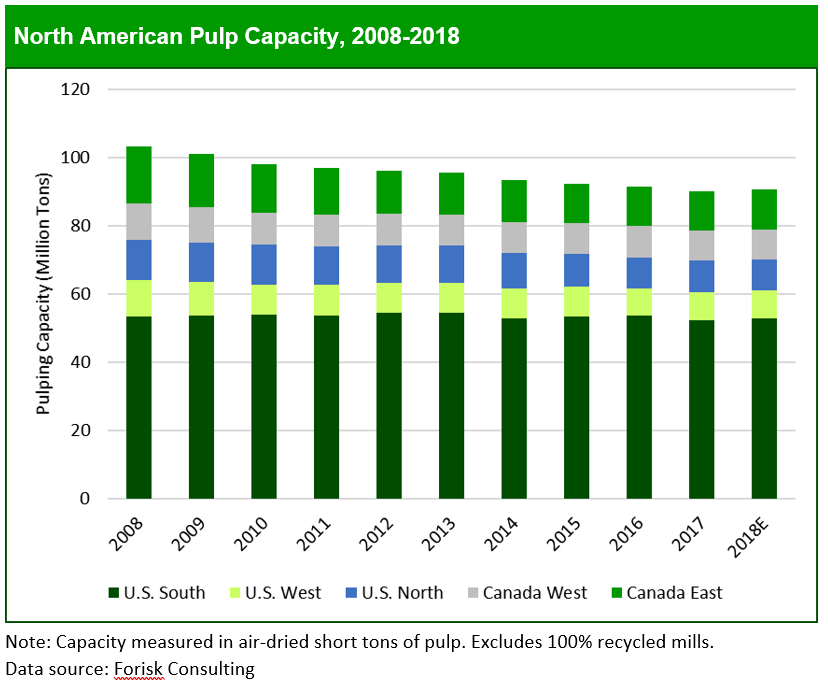

The end-use sector served by mills regionally provides important context to understand pulping capacity. The South has clear advantages over other regions, with the majority of both household/sanitary and packaging capacity. This has served as a bulwark against the paper industry’s overall decline over the past decade (Figure). Total pulping capacity in 2018 is 91 million tons, 12% less than the sector’s 103 million tons of capacity in 2008. Capacity declined in every region, but end-use exposure affected the scale of those shifts. The South has been and remains the largest pulping region, growing from 52% to 58% of North American capacity. Every other region shrank in proportional relevance, led by Eastern Canada, which represented 16% of total capacity in 2008, compared to 13% in 2018. Western Canada’s proportion dropped the least (0.5%) and remains around 10%.

The drop in pulping capacity is a function of mill closures. Between 2008 and 2018, the number of pulp mills decreased by 18%, while average pulp mill capacity increased 7%. Average capacity declined only in East Canada (0.6%), which also saw the greatest drop in operable pulp mills (30%). Average capacity increased in the other regions through investments and closure of smaller facilities. No new pulp mills have been built, though a small number of mills that were not operating in 2008 have reopened.

This post contains an excerpt from Forisk’s Multi-Client Study: North American Forest Industry Capacity, a comprehensive analysis of wood-using capacity – current, historic and projected for 2008-2020 – by firm and sector across five North American regions. For more information, click, here.

Leave a Reply