This is the first in a series related to Forisk’s Q4 2018 forest industry analysis and timber price forecasts for the United States.

Despite September housing starts declining 5.3% on a seasonally adjusted annual rate (SAAR) from August’s downwardly revised number, unadjusted actuals continue to improve. Through September of 2018, U.S. housing starts increased 6.4% year-over-year; single-family starts increased 6.0%, while multifamily starts rose 7.3%. Year-to-date housing starts are at their highest levels in over a decade; they still trail 2007 by 10% and remain 39% below the highs of 2005.

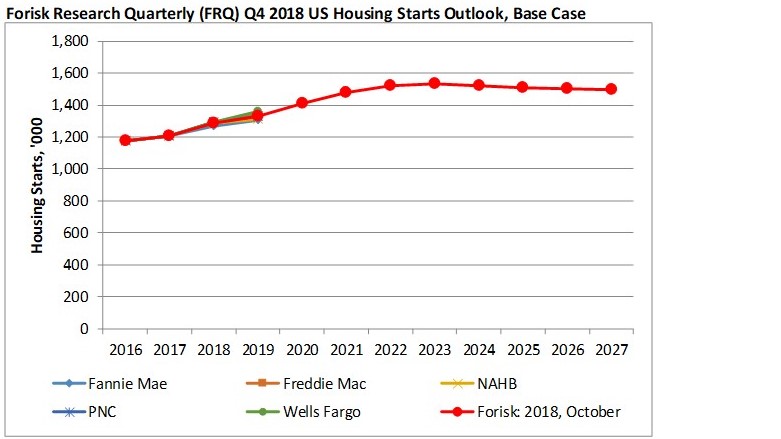

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Freddie Mac, the National Association of Home Builders (NAHB), PNC, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Forisk projects 2018 housing starts of 1.285 million, up 6.8% from 2017 actuals. Forisk’s 2018 Base Case peaks at 1.53 million housing starts in 2023 before returning to a long-term trend approaching 1.50 million. Our current forecast represents a 1.3% decrease from our July 2018 forecast and essentially brings us back to our first forecast of the year. We projected housing starts of 1.284 million in January of 2018. David Byrne put it best, “Same as it ever was. Same as it ever was.”

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply