My first exposure to pallet manufacturing came while working as a harvest manager and log buyer for a pine sawmill in Barnesville, Georgia in the mid-1990s. While procuring pine logs for our mill, I often sold hardwood pallet logs to Southern Forest Industries (SFI) in Smarr, which sawed them into lumber and pallet stock, and also manufactured pallets.

The log buyer at SFI, Ron Aivalotis, helped me understand how buying logs for pallet plants requires scavenging skills. You live in a narrow space between pulpwood bought by mighty pulpmills and sawlogs bought by grade sawmills. Pallet mills live in a narrow tranche, a wavering middle ground in the world of buying logs and timber.

The first post in this series introduced the U.S. wood pallet industry. This second post reviews a key lesson related to forest industry competitiveness and margins over time, which we also explore at Wood Flows & Cash Flows events and in the Forisk Research Quarterly.

Know Your Economic Place in the Forest Industry Universe

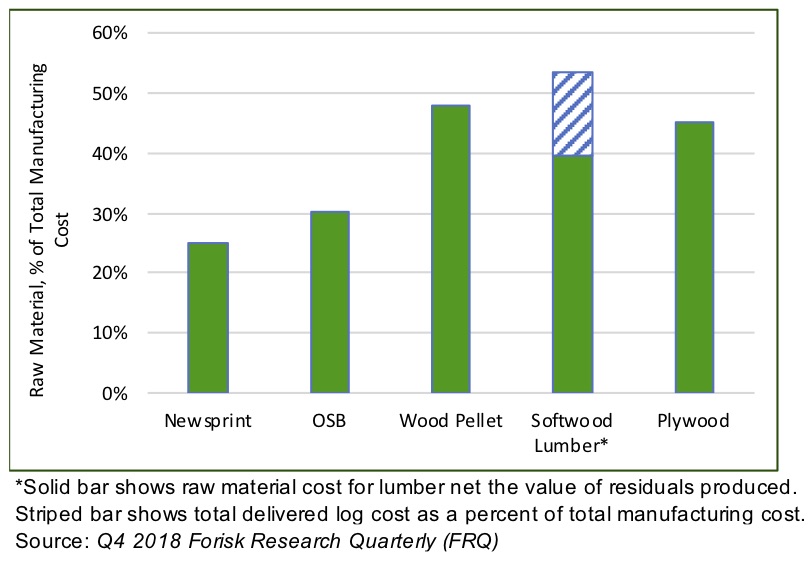

My research with PalletOne reinforces this key lesson: survival requires understanding your place in the forest industry universe at any given time. All forest products plants are subject to the supreme ability-to-pay for logs of the pulp and paper sector. While lumber and plywood and any product that requires sound, older logs pay more for their raw material on a per unit basis, pulp and paperboard plants have superior margins. Wood raw materials account for a smaller portion of their total manufacturing cost. For pallets, wood accounts for 50-55% percent of the manufacturing cost. Figure 3 summarizes wood raw material costs as a percent for other sectors across the industry.

Figure 3. Wood Raw Material as a % of Total Manufacturing Costs (U.S. South)

While PalletOne’s operations include four hardwood sawmills in four different states, the message remains consistent across operations. Dorothy Hostetler, the General Manager of the Shipshewana, Indiana operations, explains it this way:

“When studying accounting [in college], I read a paragraph which said most accounting for inventory is straightforward except for two businesses: butchers and sawmills, where grading is so important.”

In short, wood pallets live on the low-grade side of softwood and hardwood lumber, and you have to manage and understand that all time.

Our Q3 2018 white paper on forest industry disruptions provided a framework for thinking through changes affecting sectors locally and nationally. This post shared one lesson related to relative competitiveness, which changes over time. Success in the wood pallet business (and forestry) requires, among other things, being good at math. If you failed arithmetic, forget the forest products industry. But the numbers of ability-to-pay tell just one part of the story.

We continue with these lessons in Part III.

Not sure which group should be more pleased with the comparison, but I guess butchers and saw millers both share the same job related risk of severed appendages!

A very thought provoking story, keep ’em coming.