On September 24, 2018, China implemented additional tariffs on over 5,000 U.S. products worth $60 billion. The levies cover certain logs and chips at either a 5% or 10% rate. These tariffs were in retaliation to the 10% duty placed on $200 billion of Chinese goods by the U.S. and follow two previous rounds of tariffs between the two countries. On August 23, China implemented tariffs on $16 billion worth of U.S. goods, which included a levy of 25% on Southern Yellow Pine logs. Chinese tariffs on U.S. products worth $34 billion went into effect on July 6.

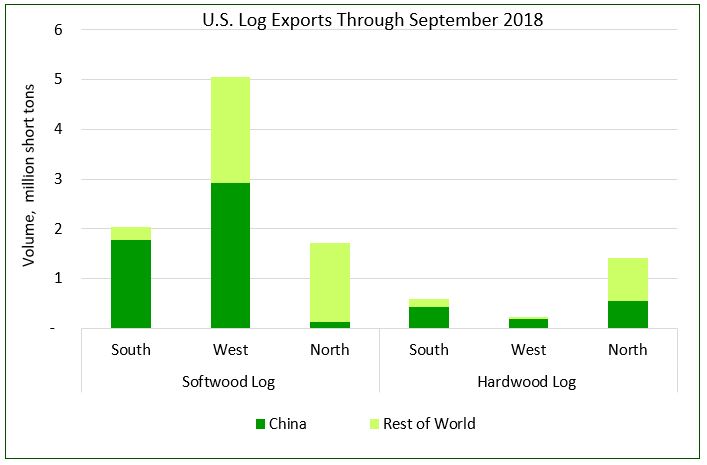

Prior to the implementation of the tariffs, U.S. log export markets were concentrated in China, which was the largest importer of both U.S. softwood and hardwood logs. Through September 2018, 54% of all U.S. roundwood exports were destined for China: 55% of softwood log exports and 52% of hardwood log exports. Regionally, the U.S. South and West are most exposed to tariff effects (Figure). Through September 2018, 84% of log exports from the South went to China: 87% of softwood log exports and 72% of hardwood log exports. The West, the largest log exporting region in the U.S., sent 59% of its log exports to China, 58% of all softwood logs, and 78% of all hardwood log volume. The North is less exposed, with only 22% of the region’s logs destined for China.

Source: U.S. Census Bureau

U.S.-China trade talks are scheduled for the week of January 7, 2019. Should the two countries fail to come to an agreement, the most recent September U.S. levies will escalate to 25% in March 2019. Should China retaliate, the Trump administration has threatened additional tariffs on $267 billion worth of Chinese merchandise. It is unknown how China will respond to these actions.

Research on export market trends supports analysis of wood markets, timberland and other forestry-related investments. To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply