This is the third in a series related to Forisk’s Q1 2019 forest industry analysis and timber price forecasts for the United States.

New sawmills in the South were announced at a rapid clip in 2018, accelerating a trend of sawmill expansions and re-openings that began in 2012. Let’s pause to catch our breath and take a look back at some of these announcements to consider what we might expect moving forward.

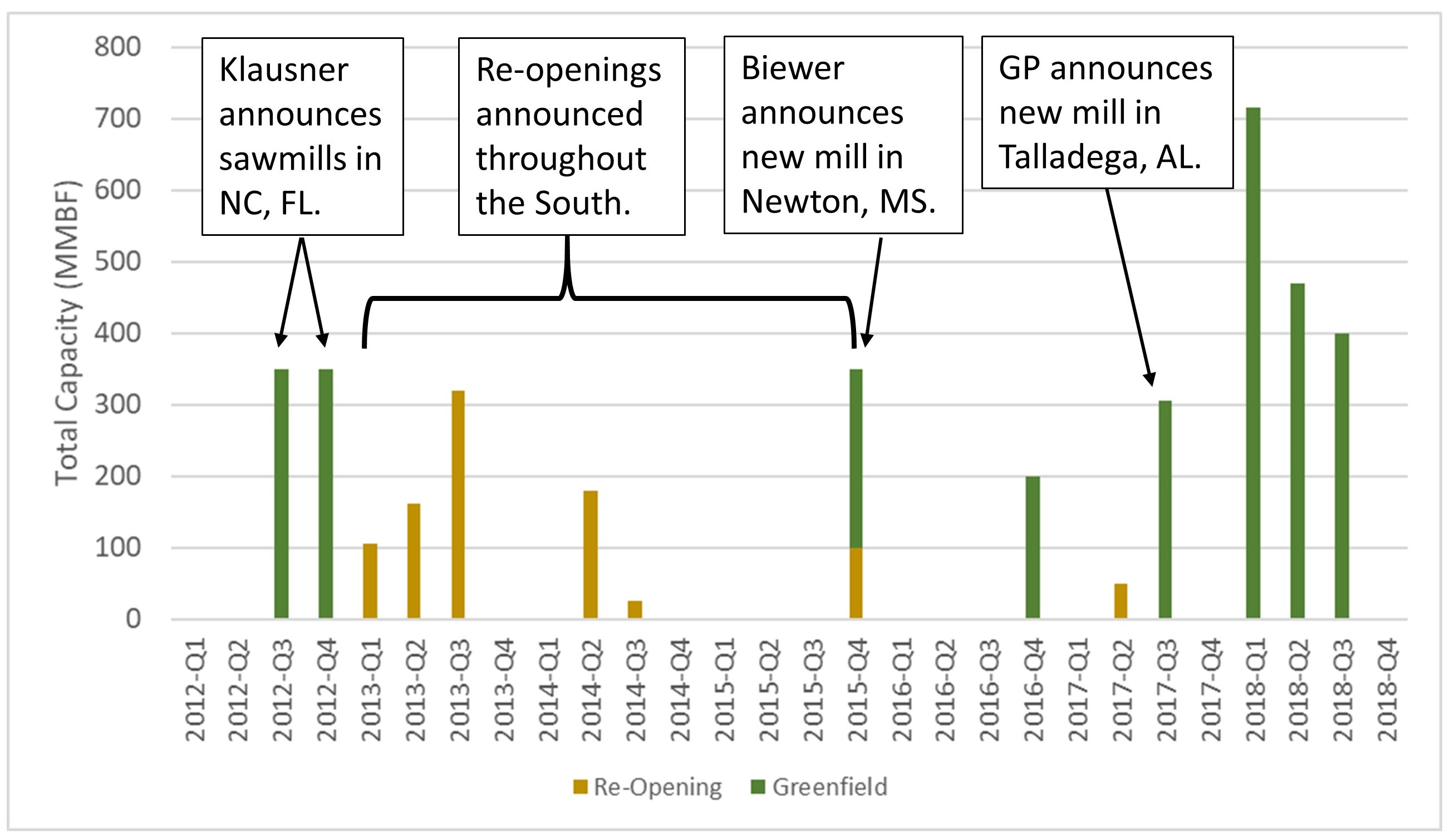

Klausner Group was the first company to propose greenfield sawmills in the South following the Great Recession, announcing plans for 350 MMBF sawmills in Live Oak, FL and Enfield, NC in late 2013 (another proposal in Orangeburg, SC did not materialize). Live Oak experienced episodes of extended downtime after its opening in 2015, while Enfield just recently opened after a years-long string of delays. Both currently operate well below announced capacity. (Figure 1)

Three years would pass before the next greenfield sawmill announcement, but multiple sawmills that had been shuttered during the worst of the recession re-opened in the interim – sometimes under new ownership. Near the end of 2015, Biewer Lumber announced a new 250 MMBF sawmill to be built in Newton, MS. This mill opened on schedule and recently announced an additional 100 MMBF at the mill, slated to be finished by the end of this year.

Finally, in September 2017, Georgia-Pacific announced a new 230-MMBF sawmill on the site of their shuttered plywood mill in Talladega, AL, opening the floodgates for nearly 2 billion board feet of greenfield sawmill announcements between Q3 2017 and Q3 2018. The last quarter was a quiet one, by comparison. Westervelt announced the location of the 250-MMBF sawmill they proposed earlier in the year, while other companies quietly shelved plans for new sawmills in the South.

What could we expect going forward? Announced greenfield sawmills and capacity expansions at existing sawmills would bring the South’s total softwood lumber capacity to nearly 25 billion board feet by 2020. Southern lumber production would need to increase by 15% over the next two years (7+% annual growth) to require that much capacity, assuming 90% utilization. While operating margins for southern sawmills are still robust, housing and GDP have slowed. Absent a fundamental shift in lumber demand, 2018, with its nearly 2 billion board feet in greenfield sawmill projects, may indeed be remembered as the year of “peak sawmill” announcements.

Leave a Reply