This is the seventh in a series related to Forisk’s Q1 2019 forest industry analysis and timber price forecasts for the United States and Canada. The post includes an excerpt from the bioenergy research, authored by Andrew Copley and Amanda Lang.

Wood pellet production capacity in North America has increased 170% over the past decade. Growing to meet European demand for renewable energy—and more recently demand from Asia—wood pellet manufacturing capacity has consolidated and shifted across regions. Today, the U.S. South is the largest wood pellet producing region in North America, accounting for over half of all manufacturing capacity.

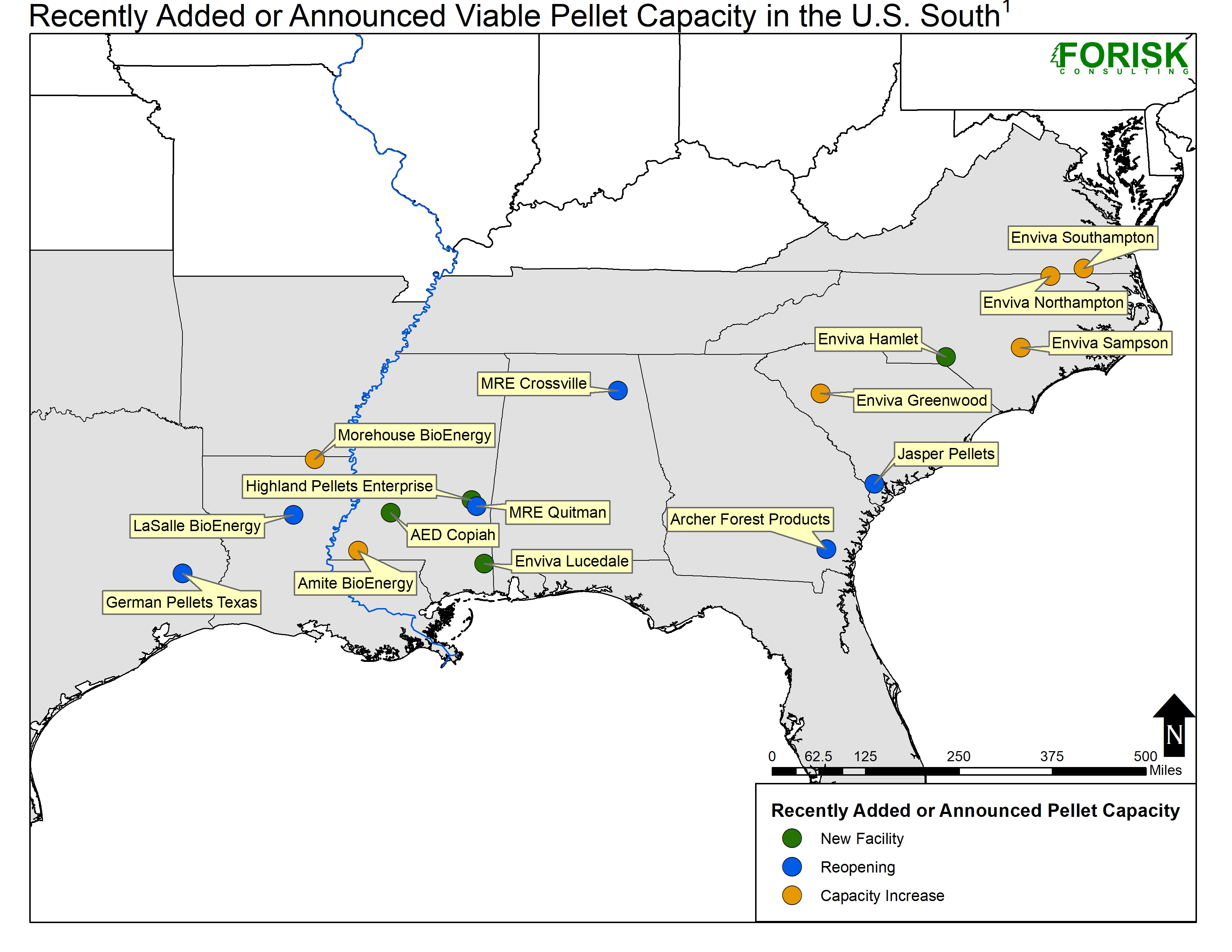

Capital continues to flow to the sector (Figure). Driven by export-oriented projects, capacity in the U.S. South is expected to advance 47% over the next two years, adding over four million metric tons. Enviva alone represents 49% of this growth, bringing almost two million metric tons of new capacity online by 2020. Enviva Hamlet’s 600 thousand metric ton facility is scheduled to be online by H1 2019. The company recently announced plans to build a new facility in Lucedale, MS, which is expected to be 600 thousand metric tons. Enviva has also announced numerous capacity increases at existing facilities: Enviva Greenwood is expected to reach 600 thousand metric tons by 2019; Enviva Sampson is increasing capacity by 100 thousand metric tons in 2019; Enviva’s Northampton and Southampton mills are expanding capacity by a combined 400 thousand metric tons in 2020.

[1]Forisk tracks and screens all publicly announced wood-using bioenergy projects for viability. ”Viable” bioenergy projects are those that pass Forisk’s two-part screening associated with (1) proven technology and (2) operational milestones.

Leave a Reply