This is the third in a series that shares insights from a decade of research related to North America’s wood bioenergy sector. Part I introduced core themes and wood pellets and Part II outlined the value of simple screening and ranking tools to prioritize investment risks.

Lesson Two: Connect Wood Markets to End Markets

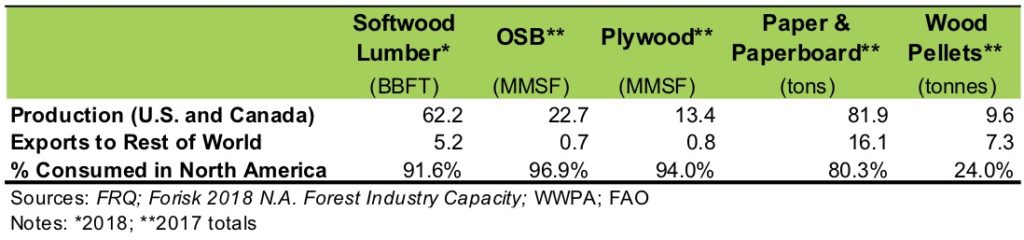

In bioenergy, manufacturers buy wood locally and sell pellets globally. This distinguishes wood pellets from other forest products, where most production gets consumed domestically or in neighboring countries. For North America, over 90% of solid forest products and over 80% of paper and paperboard production get consumed in the U.S. and Canada, while over three out of four pellets (76%) get shipped out by ocean-crossing exporters (Figure 4).

Figure 4. North American Forest Products Exports as Share of Production

Globally, most forest products move regionally; on a volume basis, intercontinental exports represent the exception. The reasons are simple: forest products are heavy, bulky and expensive to ship. The math of freight costs and law of gravity, buffeted by exchange rate volatility, enforce a quasi-limit on forest industry trade relative to domestic demand for most developed economies (outside of New Zealand).

This emphasizes the core “timber markets are uniquely local” tenet of forest industry analysis. Once we get past the localized fundamentals of supply (is the wood there?) and demand (are the mills there?), we assess risk and manufacturers through the economics of (1) distance and (2) margin by asking:

- How much does it cost to deliver product and serve customers?

- What is their ability-to-pay for wood?

In this way, distance and margin provide quantitative measures of risk and opportunity. If I can cut the distance between links in my supply chain – from the woods to the mill, or from the mill to my customers, or between logs on the sharp chain – then I save time, gain volume and reduce costs. And the extent to which any of these get improved relative to competitors will grow margins and strengthen raw material security.

Very thoughtful piece. You have to wonder about the sustainability of wood pellets moving around the globe, yet we see Japan becoming very committed and Great Britain continuing their major programs. I’ll check back with you in 2028 about the 81 million tons per year for energy use….