This is the fourth in a series related to the Q4 2019 Forisk Research Quarterly’s (FRQ) forest industry analysis and timber price forecasts for North America.

Publicly-traded timber investments struggled in 2018. Only direct timber investments generated positive returns in 2018. However, public timber REITs returned 30.1% through the first ten months of 2019, leading all indices and vehicles tracked by Forisk.

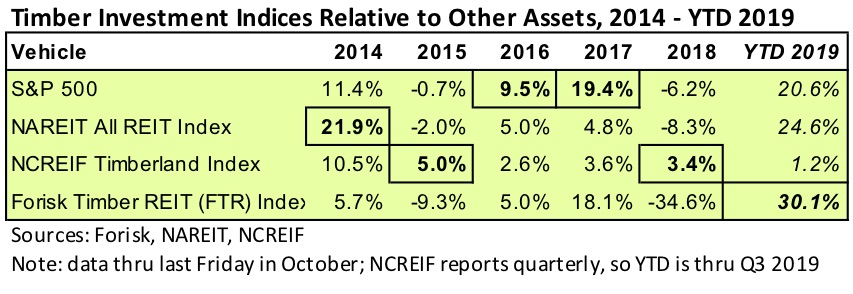

The table above compares 2014 through 2018 annual and YTD 2019 performance of indices tracking the S&P 500, all publicly traded real estate investment trusts (NAREIT), private timberlands (NCREIF), and public timber REITs (FTR). The timber REITs in the FTR Index include CatchMark Timber Trust (CTT), PotlatchDeltic (PCH), Rayonier (RYN), and Weyerhaeuser (WY).

The year-by-year ranking highlights the shifting of capital and performance across sectors, with the volatile, periodic returns of equities (S&P, NAREIT and FTR) versus the relatively stable, positive returns of timberlands (NCREIF) since 2014. Private timberlands, the only benchmark to generate positive returns for each of the past five years, topped the list in 2018. Public timber REITs ended 2018 last with their first negative year since 2015, which was also the last year private timberlands led this set of benchmarks. Timber REITs bounced to the front in 2019, making up ground lost in 2018 as of October 2019.

For a day dedicated to sharing and discussing research and insights related to forest industry operations and timberland investments, register for Wood Flows & Cash Flows, Forisk’s annual conference on December 5th in Atlanta. Executive Panelists will address threats and risks to the forest industry.

Leave a Reply