This is the fifth in a series related to the Q4 2019 Forisk Research Quarterly’s (FRQ) forest industry analysis and timber price forecasts for North America.

Hurricane Michael hit the Florida panhandle and southwest Georgia as a category 5 hurricane on October 10, 2018, causing significant timber damage. The Florida Forest Service estimates that 2.8 million acres of timberland, including 72 million tons of timber, were damaged. The Georgia Forestry Commission estimates an additional 2.4 million acres of timberland, including 38 million tons of timber, were impacted there. How has this natural disaster impacted timber supply outlooks in these timber markets?

The Southern Forest Resource Assessment Consortium (SOFAC) did an assessment of timber supplies in the damaged area using U.S. Forest Service FIA data, as Forest Service efforts to cruise the damaged areas are still underway. The approach used damage estimates from the Georgia Forestry Commission and Florida Forest Service in combination with analysis of damage from Hurricane Hugo (which hit Charleston, South Carolina in 1989 as a Category 4 storm).

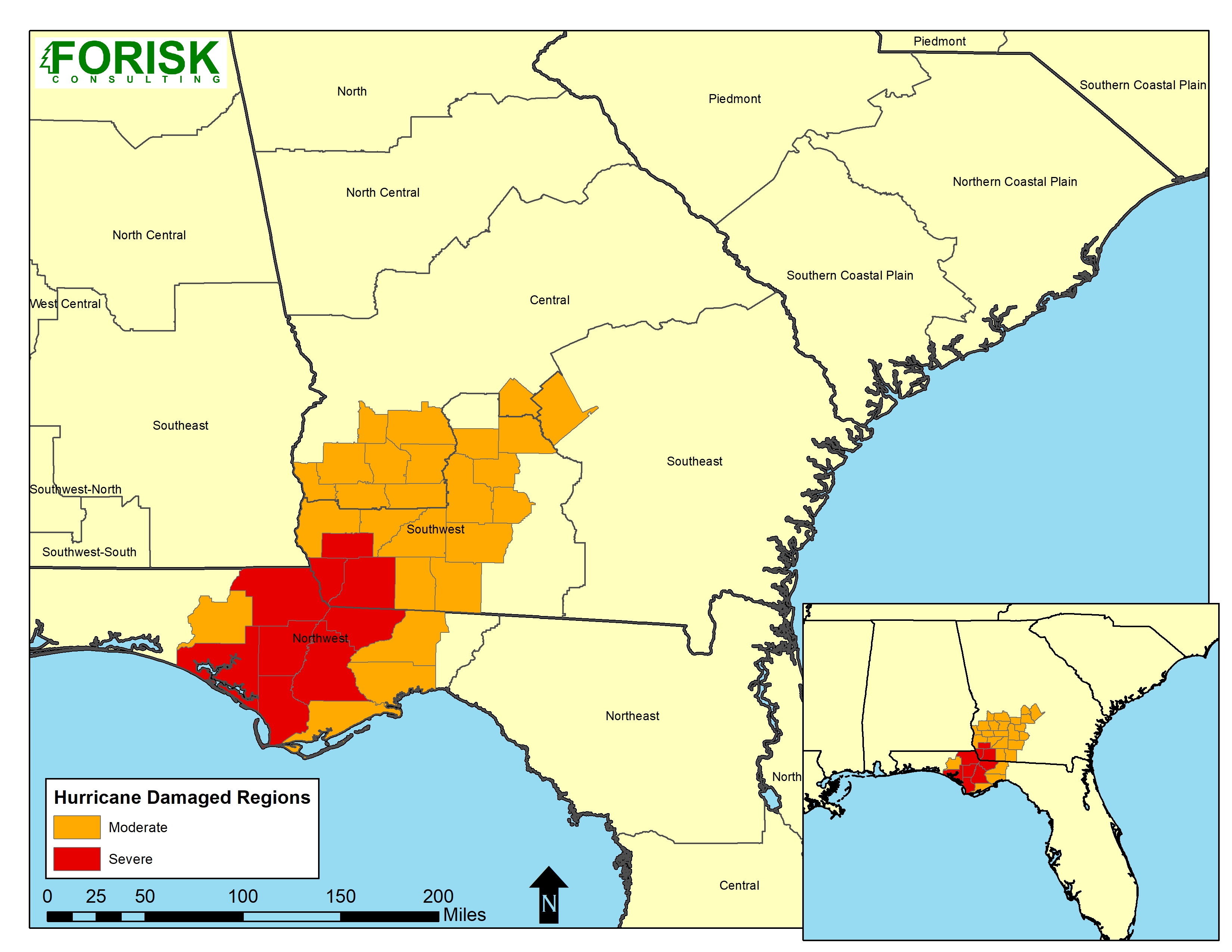

Forisk updated timber supply projection models this quarter. We incorporated impacts from Hurricane Michael in our Georgia and Florida state-level models based on either moderate or severe damage to standing timber using regions[1] defined in the SOFAC research (Figure). To report effects of the hurricane on timber supplies in the region, we compare inventory estimates for the FIA units where storm damage occurred.

[1] The “severe” region had timber losses of 50% or more; the “moderate” region had timber losses of 10% – 50%.

The estimate of current standing timber inventory in Northwest Florida is 28% lower for pine after Hurricane Michael and 19% lower for hardwood. The damage in Georgia was spread over three FIA units; we report comparisons for the combination of Central and Southwest Georgia (only one county in Southeast Georgia was impacted). Still, the inventory effects are masked by large, unaffected areas of the Central Georgia FIA unit. Overall, the standing inventory for pine declined by 3% (led by an 8% in pine pulpwood), while hardwood inventory was flat.

Forisk thanks Dr. Bob Abt with SOFAC for his assistance with this research.

For a day dedicated to sharing and discussing research and insights related to forest industry operations and timberland investments, register for Wood Flows & Cash Flows, Forisk’s annual conference on December 5th in Atlanta. Executive Panelists will address threats and risks to the forest industry.

Leave a Reply