This is the first in a series related to Forisk’s Q1 2020 forest industry analysis and timber price forecasts for the United States.

In 2019, housing starts improved year-over-year in all market segments: total housing starts advanced 3.2%; single-family starts increased 1.4%; and multifamily starts rose 7.4%. U.S. housing starts ended the decade with ten consecutive years of growth. Despite this continued growth, housing starts were, on average, 35% lower over the past decade when compared to the previous decade. In the 2000s, housing starts began at 1.569 million, rising steadily through 2005, before collapsing into the Great Recession and ending at 0.554 million starts in 2009. The average annual growth for the decade was -8.6%. The 2010s began at 0.587 million starts, gaining annually, before reaching 1.290 million starts in 2019, with an average annual growth rate of 9.1%

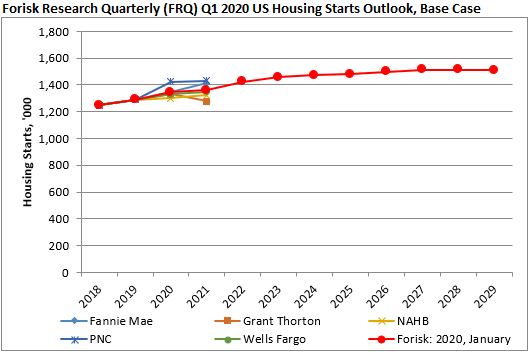

When updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Grant Thorton, the National Association of Home Builders (NAHB), PNC, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Forisk projects 2020 housing starts of 1.347 million, up 4.5% from 2019 actuals. Forisk’s 2020 Base Case stabilizes around its long-term trend of 1.50 million housing starts. This is due to underlying demand based on demographics and household growth, second home ownership, and net replacements of existing housing stock.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply