Timberland investors and forest industry executives entered 2020 expecting to navigate the tradeoffs of a slowing global economy, disruptive trade policies and a surging U.S. housing market. However, halfway through the quarter, as Tim Gammell, Editor of the Forisk Wood Fiber Review (FWFR), spoke with industry contacts across North America, the tone started to shift. One pulp mill executive noted, “Our position has changed since…a few days ago.”

With market exposure to China and coronavirus uncertainties, the forest industry started taking a hard look at expectations for the year. Forest products manufacturers such as Canfor, Interfor, West Fraser, and Weyerhaeuser, with plants in both Canada and the U.S., started announcing reductions in capital expenditures and lumber production for 2020.

Given the mayhem, how did pricing for wood fiber look? In the U.S. South Central states, softwood roundwood remained flat, while softwood residual chips (-1%) dropped. Fiber prices in the Southeast declined modestly. In the U.S. Lake States, softwood chips and hardwood chip and roundwood prices started 2020 unchanged from 2019 levels, while softwood roundwood fell. In the Northeast, fiber prices, other than softwood chips, increased 3-5% year-over-year.

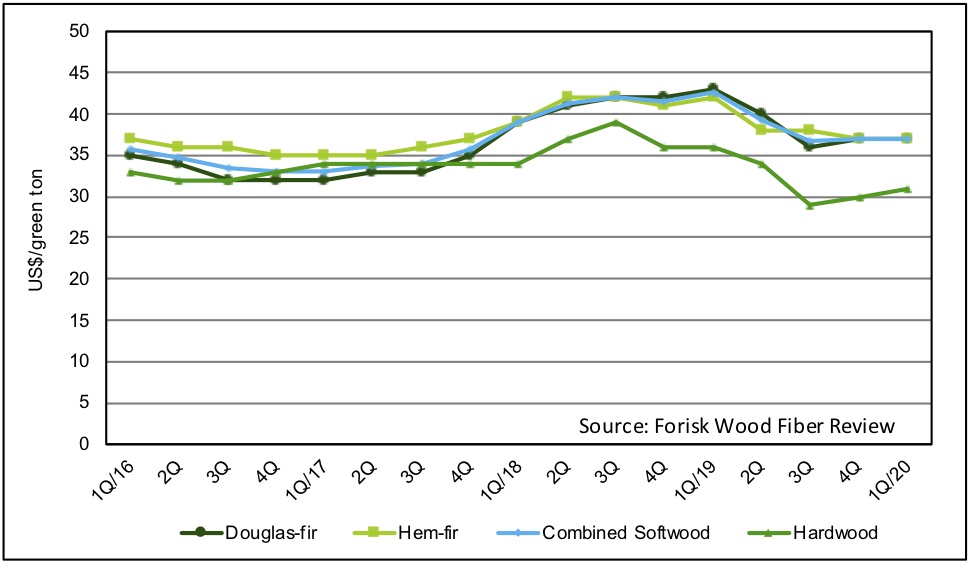

Overall, softwood pulplog prices in the U.S. Northwest remained steady for Hem-fir and Douglas-fir, as both held at regional averages (figure). However, Douglas-fir pulplogs fell 14% year-over-year and Hem-fir dropped 12% from over the same period. With no reported shortages, we continue to watch the price differential between the two major softwood log types, which effectively evaporated over the last two years.

Figure: U.S. Northwest Pulplog Prices

Eastern Canada experienced turmoil from pulpmill closures and restarts and rail blockades in early 2020. Softwood residual chips in Eastern Ontario/Quebec increased materially. Western Canada showed price moves across products, with softwood chips in Alberta increasing slightly as BC saw prices fall, leaving them down 14% since this time last year.

Looking forward, we’re watching as other firms announce adjustments to production and planned capital projects. While sawmill curtailments reduce the supply of residual chips, pulpmills and pellet plants continue to maintain strong operating postures. Regardless the economy and coronavirus, we still need cardboard, toilet paper and household (and sanitary) products.

Click here to learn about the Forisk Wood Fiber Review (FWFR), tracking pulpwood, wood chip and biomass markets in the U.S. and Canada since 1983.

Leave a Reply