This is the first in a series related to Forisk’s Q2 2020 forest industry analysis and timber price forecasts for the United States.

In Q1 2020, with strong growth in all regions, U.S. housing starts increased 22% year-over-year; single-family starts gained 12%, while multifamily starts rose 47%. Though currently tracking above 2019, housing starts declined precipitously in March 2020 as the economic impacts of the coronavirus materialized. The seasonally adjusted annual rate (SAAR) of 1.216 million units represented a 22% decline from February. This was the largest month-over-month decline since March 1984 and the fourth largest decline since the data series began in 1959.

When updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. COVID-19 creates an unknown; analysis of supply side (supply chain) and demand side disruptions vary widely. It is difficult to quantify the size and duration of the potential economic impacts. Excessive precision can create false confidence. Instead, we turn to frameworks and scenarios.

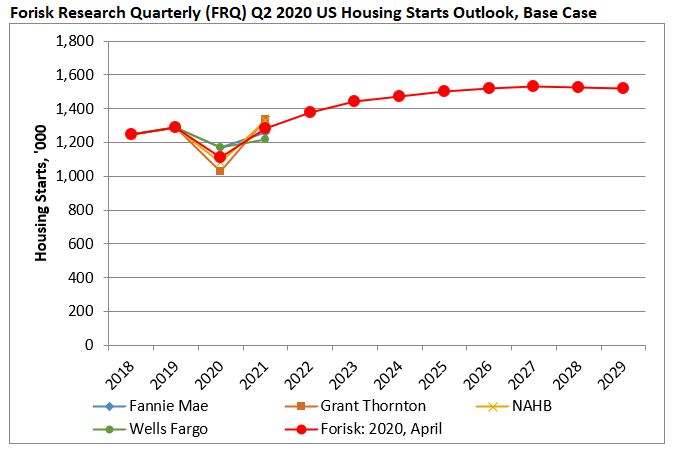

As of April, Forisk projects 2020 Base Case housing starts of 1.113 million, down 14% from 2019 actuals (Figure). Forisk’s 2020 Base Case still stabilizes around its long-term trend of 1.50 million housing starts. This is due to underlying demand based on demographics and household growth, second home ownership, and net replacements of existing housing stock. For comparison, our April forecast represents a 17% decline from our January 2020 Base Case projection of 1.347 million starts. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Grant Thornton, the National Association of Home Builders (NAHB), and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

I suspect there may be a reverse of the trend between single family units and multifamily housing demand after the recent pandemic. More people may want to continue to distance themselves to avoid future outbreaks, thus reducing the growth in demand for multifamily units.