This post is the third in a series related to the Q3 2020 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. The post includes excerpts from our pulp and paper research. Our thanks to Jack Lutz, who contributed to this research.

Forecasting pulpwood demand is not straightforward. When thinking about softwood sawtimber demand, we look to housing. While forecasting housing demand has proven challenging over the past 15 years, housing demand is strongly correlated to softwood lumber demand. If you want softwood lumber, you have to have softwood logs. So, given a housing forecast we can generate a softwood sawtimber forecast.

Pulpwood is more challenging because you don’t have to use roundwood pulpwood to make paper. Residual chips from sawmills make up a sizable portion of paper raw material. Those technically come from sawtimber, not pulpwood. Some paper and paperboard are made entirely from recovered paper pulp, with others being made entirely from wood pulp. Adding to the complexity, a large percentage is made from a combination of wood and recovered paper pulp. Also, there’s pulp made from non-wood fibers—although this is not a very large segment in the US. Still, about 2/3 of all paper in the US is made from virgin wood fiber. Some pulpwood also goes to panel plants (particleboard/OSB) and some may make its way to pellet plants or biomass plants, further complicating pulpwood demand.

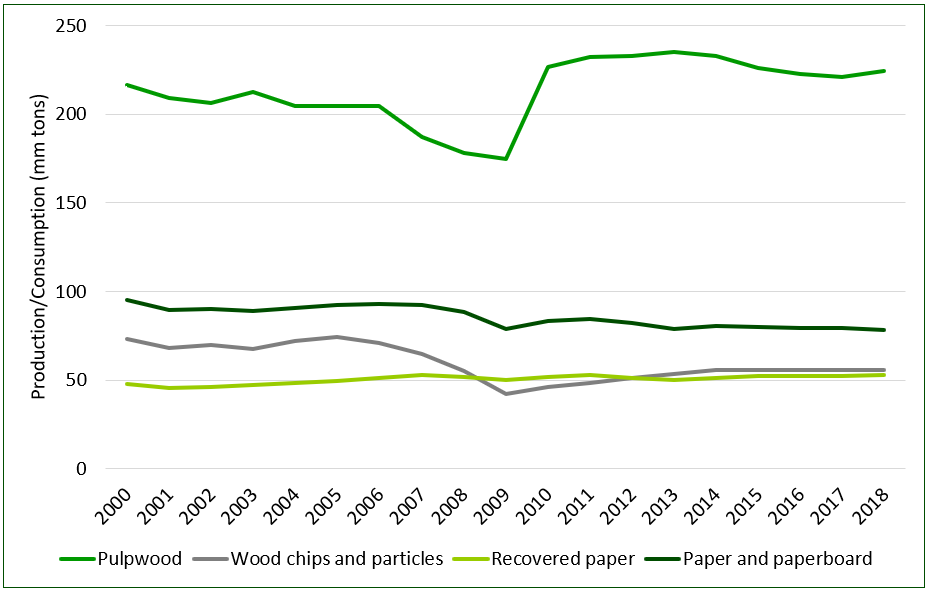

Historically, consumption of the major paper raw material sources, roundwood pulpwood, chips and residuals, and recovered paper, has varied over time (Figure). Recovered paper appears immune to volatility in paper production, growing slowly but steadily to an estimated 38% of paper production in 2018 (based on recent analysis by the Bureau of International Recycling). Chips and roundwood pulpwood also vary, with chips and residual volumes more closely linked to paper production. Roundwood pulpwood consumption in the U.S. is more volatile, indicative of its varied potential uses. Roundwood consumption varies from a low of 73% of the total virgin pulpwood supply during the midst of the housing boom, to a high of 83% during the heart of the 2008-09 recession.

Thanks! Are these tons green?