“Risk” remained the watchword over the past three months as managers continued to battle multiple issues: fires, hurricanes, COVID, and record lumber prices. Lumber production surged in Q3 2020, generating more residual volumes into fiber markets while demand from the pulp and paper sector continued to struggle with the impacts of the coronavirus on end-market products. The pandemic has deteriorated market conditions for printing and writing paper while accelerating newsprint’s decline. In the woods, the combustible mix of hot weather, strong winds, and low humidity fueled explosive fires. These stories took attention away from Hurricane Laura, which snapped 30 million tons of pine and 9 million tons of hardwood in Louisiana alone, comprising more wood than in-state mills consume in a typical year.

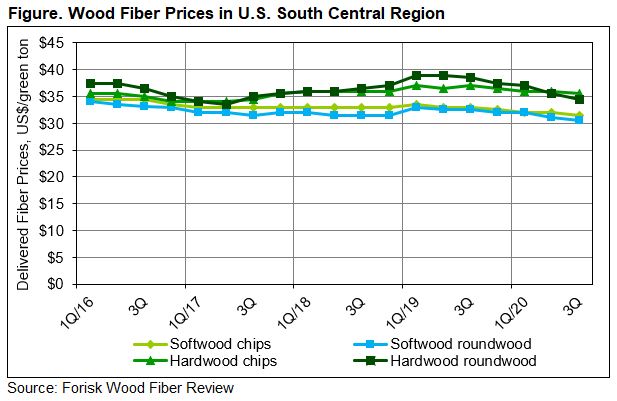

Given the market activity, how did pricing look? In the Pacific Northwest, hardwood prices remained relatively stable while softwood roundwood and chips fell 13 to 16%. In the U.S. Lake States, hardwood chips remained relatively unchanged while softwood chips dropped 2% and roundwood products were down 4% for the quarter. In the Northeast, fiber prices fell 3 to 7%. Fiber prices in the Southeast declined as they did in Q1 and Q2: soft and hard roundwood fell 2% while softwood residual chip prices dropped 3%. In the U.S. South Central region, residual chips declined 1 to 2%; softwood roundwood prices fell 2% and hardwood decreased 3%.

This post contains a sample from the Q3 2020 Forisk Wood Fiber Review. Click here to learn about the Forisk Wood Fiber Review (FWFR), which has tracked pulpwood, wood chip, and biomass markets in the U.S. and Canada since 1983.

Leave a Reply