This post is the fourth in a series related to the Q4 2020 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. The post includes excerpts from our featured research this quarter on logging capacity impacts from the pandemic.

The forest industry is accustomed to changes. Opportunities, like the mid-year climb in lumber and structural panel prices, motivate manufacturers to capture margin while they can. Unwelcome surprises, like hurricanes, fires, and the COVID-19 coronavirus, increase uncertainty for day-to-day activities, especially those in the wood supply chain. In our featured research this quarter, we evaluate logging capacity declines following demand disruptions in local markets. Our goal is to provide context for how market events, such as the pandemic, affect the forestry supply chain. We also consider how the relative strength of housing and lumber in the second half of the year impact logging capacity given the extent of mill curtailments in the second quarter.

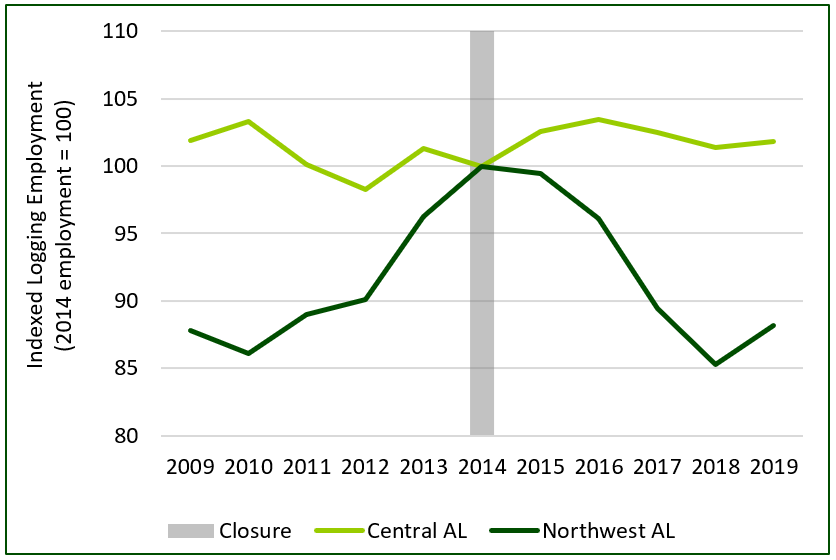

The duration, severity, and geographic extent of any market disruption inform our expectation of logging capacity impacts. When demand dips in local markets, loggers try to extend their work radius and seek better opportunities. If the dip endures, logging employment slowly declines as businesses consume cash reserves and reduce crews. Consider the 2014 closure of International Paper’s facility in Courtland, Alabama, the largest mill in Northwest Alabama at the time. Logging employment in a 75-mile radius around the mill grew rapidly through 2014, when compared to a similar-sized market in East-Central Alabama (Figure). Following the closure, employment growth ceased while the Central AL market grew moderately amidst stronger lumber markets. As of 2018, employment in Northwest AL was 15% below 2014 levels while the Central AL market remained 1-2% higher.

This example reinforces a theme we observe nationally in the wood supply chain: logging capacity is resilient in the short-term, while extended declines are devastating. Local impacts hurt, but widespread declines offer no outlets for contractors seeking to maintain wood flows and cash flows. Extended declines, such as the 2008-09 recession, are the most damaging while short-term drops, such as a mill closing for repairs over a month or two, cause acute pain but little lasting impact to capacity.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447. To sign up for Forisk’s annual conference, Wood Flows and Cash Flows, click here or email Heather Clark at hclark@forisk.com.

Leave a Reply