A historic fire season continued to be the dominant story across the U.S. West as landowners assessed damage to timberlands, tried to arrange salvage operations, and planned for recuperating damaged lands. The toll of a destructive 2020 wildfire season is still being tallied, but nearly 2 million acres of forestland in Oregon and Washington alone were within active fire boundaries. While significant areas were on federal land, private, industrial landowners suffered a much greater loss than in previous fire seasons. Logging equipment losses were in the tens of millions of dollars as well, challenging capacity to ramp up salvage operations. Concerns turned towards recovery and the massive seedling demand needed to replant salvaged acres.

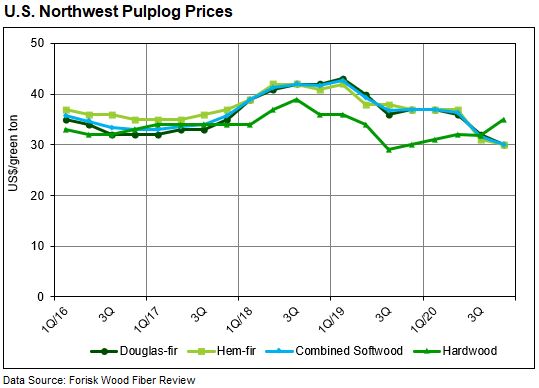

Fire damaged logs started flowing into area sawmills though the effect of salvaged logs on markets remained unclear halfway through Q4. Continued high lumber prices encouraged sawmills to maintain aggressive production levels, further increasing residual chip supplies in the region. In a year defined by turmoil, many pulpmills, which had deferred or extended outages, were back to normal operations. Softwood pulplog demand remained low as residual chip volumes continued to displace higher-cost pulplogs. Quarter-over-quarter prices fell an additional 3-6% for Hem-fir and Douglas-fir. Year-over-year, both Douglas-fir and Hem-fir pulplog prices fell 19%. In contrast, hardwood pulplogs trended sharply higher, up 10% for the quarter and 17% year-over-year.

This post contains a sample from the Q4 2020 Forisk Wood Fiber Review. Click here to learn about the Forisk Wood Fiber Review (FWFR), which has tracked pulpwood, wood chip, and biomass markets in the U.S. and Canada since 1983.

Leave a Reply