The Paycheck Protection Program (PPP) was a critical lifeline for thousands of small businesses across the U.S. PPP loans provided up to two months of payroll support for qualified businesses. In the logging sector, effectively all companies qualified. According to data from the Small Business Administration, 5,532 logging businesses in the U.S. took advantage of the program, representing 69% of U.S. logging businesses, based on unemployment insurance filings. This overstates the total percentage somewhat as a number of self-employed and contract employee loggers do not file unemployment insurance, yet qualified for, and received, PPP loans. In 13 states, the number of logging businesses receiving PPP exceeded the total number of logging businesses reported in the state. Missouri’s 76 additional logging businesses represented the greatest addition, adding 70% to the state’s total, followed by Kentucky (32 businesses) and Tennessee (26). Removing the 250 self-employed and contract employee recipients, 66% of the industry received PPP loans.

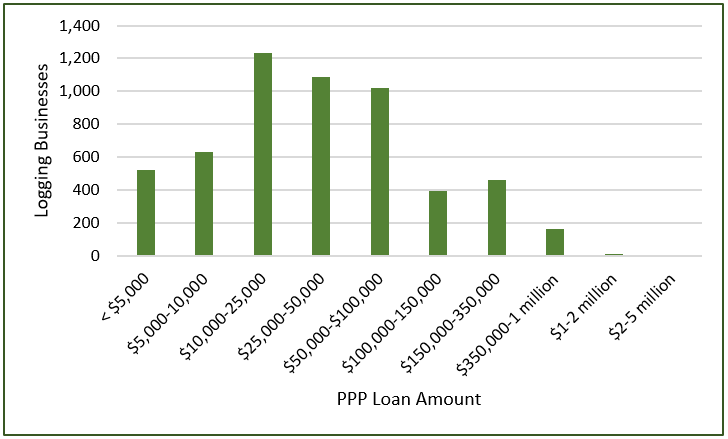

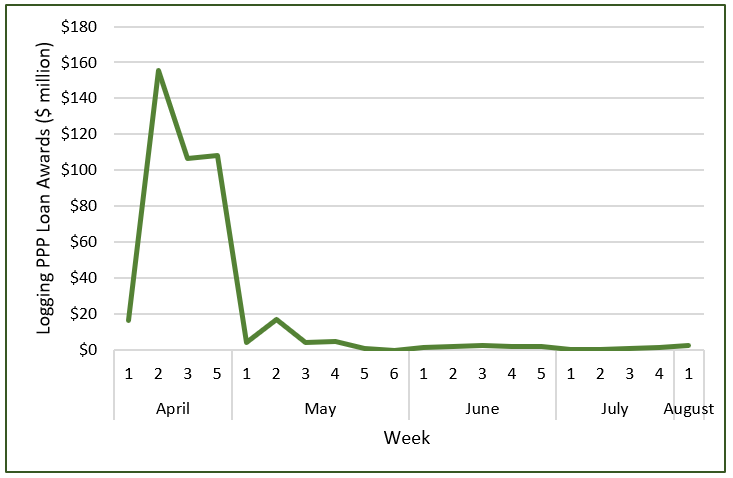

Loans were awarded based on the size of businesses, and while values varied from a surprising low of $87 to a high over $2 million, the majority of loans (63%) were under $50,000 (Figure 1). The largest portion of the estimated $436 million[1] in logging business support was issued in April. Only an estimated $49 million (11%) was issued in May or later, suggesting that most financial support for logging payrolls affected second quarter employment (Figure 2).

Timing was critical. Wood demand dipped in April and May as many mills took precautionary curtailments, fearing significant drops in end-product demand. Apart from some pulp and paper facilities, which saw extended curtailments, most of the industry resumed full operation in the summer and demand surged as the need to replenish depleted supply chains pushed prices higher. The alignment of PPP loans with this two-month demand dip should have cushioned much of the industry from whipsawing cash flows as markets slowed and rebounded.

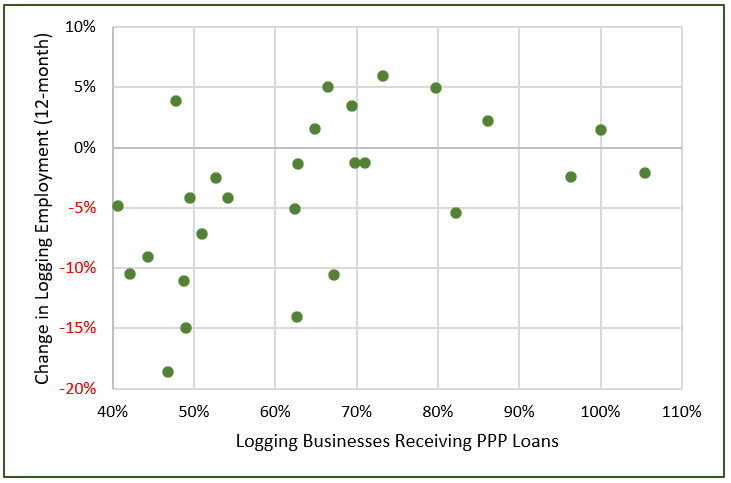

Data bear this out. States in which 70% or more of the logging businesses received PPP loans reported an aggregate 1% drop in logging employment between June 2019 and June 2020. States with less than 70% of businesses receiving PPP loans reported an aggregate drop of 5% in employment (Figure 3). The loan program was an effective buffer for much of the industry against second-quarter market disruptions.

For additional research and analysis of the forest industry, click here or call Forisk at 770.725.8447 to learn about the Forisk Research Quarterly (FRQ).

[1] Totals are estimated as actual loan amounts over $150,000 are provided in ranges. The mid-point of those ranges was used to estimate total loan values for the 643 logging PPP loans valued $150,000 and above.

Leave a Reply