This is the third in a series related to the Q1 2021 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

The U.S. housing market continued to trend higher in December, driven by increased levels of single-family home construction. The seasonally adjusted annual rate (SAAR) of 1.669 million units represented a 5.8% increase from November. While multifamily housing starts remained volatile, declining over 14%, single-family starts increased for the eighth consecutive month, gaining 12%. The 1.338 million unit rate, which represented over 80% of total starts, was the highest level of SAAR single-family starts since September of 2006. This trend looks to continue into 2021 as permits increased 4.5% from the previous month with single-family permits rising 7.8%.

For the year, despite a pandemic induced slowdown in the first half of 2020, U.S. housing starts increased for the eleventh consecutive year. Starts advanced 7.0% to 1.380 million; single-family starts rose 12% while multifamily starts fell 3.3%. The housing market shifted to higher-levels of single-family home construction, which represented 72% of total starts in 2020. This was the highest level in a decade.

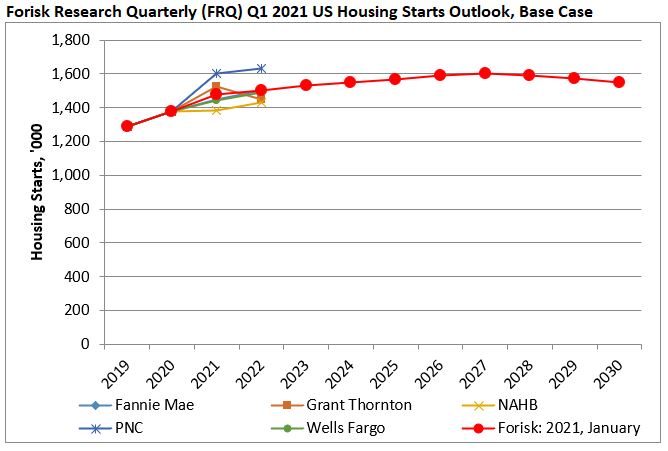

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, Grant Thornton, the National Association of Home Builders (NAHB), and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Forisk projects 2021 housing starts of 1.481 million, up 7.3% from 2020 actuals. Forisk’s Base Case peaks at 1.602 million housing starts before returning to a long-term trend approaching 1.50 million. The independent housing forecasts captured in Forisk’s Housing Starts Outlook reflect the range of expectations for 2021, indicating the unusual dynamics of housing markets at this time. For example, PNC leads with a 2021 forecast of 1.605 million while the National Association of Home Builders (NAHB) trails with its most recent forecast of 1.383 million.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply