This is the second in a series related to the Q2 2021 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

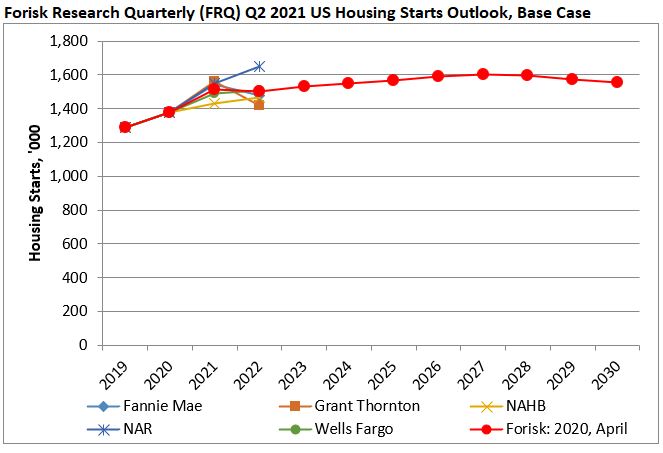

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, the National Association of Realtors (NAR), Grant Thornton, the National Association of Home Builders (NAHB), and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Forisk projects 2021 housing starts of 1.514 million, up 9.8% from 2020 actuals. Forisk’s Base Case peaks at 1.605 million housing starts before returning to a long-term trend approaching 1.50 million. While the independent housing forecasts captured in Forisk’s Housing Starts Outlook indicate the general consensus that housing starts will trend higher in 2021, they also reflect the range of expectations for 2022. For example, the NAR leads with a 2022 forecast of 1.650 million while Grant Thornton trails with its forecast of 1.420 million.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

Leave a Reply