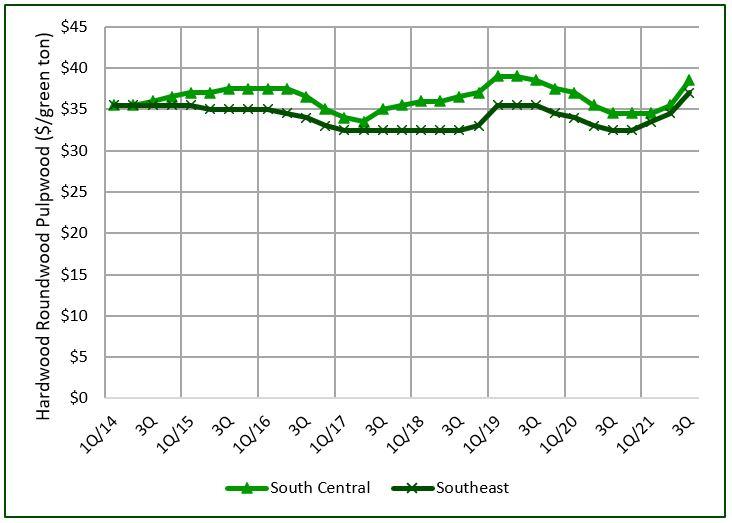

Wet ground from South Carolina to Texas hampered harvesting operations and pushed third quarter southern pulpwood prices higher. At least seven named storms landed in the South since June, dousing portions of the Gulf states. Hardwood, which often grows in wet areas, suffered the greatest impact as loggers struggled to maintain production. Southern hardwood roundwood prices in the Q3 2021 Forisk Wood Fiber Review (FWFR) increased 7-8% for the quarter, up 12-14% year-over year. Softwood inventories were also low at some pulp mills, as wood suppliers focused on hardwood harvesting, weather permitting.

Constrained trucking capacity only added to the misery. Most pandemic-related enhanced unemployment programs ended, but loggers were still experiencing a crippling truck driver shortage. Quotas were lifted across southern mills in an effort to build inventory headed into the winter. However, limited hauling capacity challenged the logging sector’s ability to respond rapidly to demand increases. Landowners and consumers are voicing concerns about costs of on-going hauling shortages as delivered prices increase. Trucking issues were also affecting other parts of the supply chain, as mills struggled to attain new equipment and critical replacement parts. A summer surge in southern Covid cases saw southern operations facing challenges on multiple fronts.

This post contains a sample from the Q3 2021 Forisk Wood Fiber Review. Click here to learn about the Forisk Wood Fiber Review (FWFR), which has tracked pulpwood, wood chip, and biomass markets in the U.S. and Canada since 1983.

Leave a Reply