This excerpt from the Q4 2021 issue of the Forisk Wood Fiber Review highlights our coverage of Western Canada where a series of damaging events in November saw bad news piled on worse news. It is just as well that Canada celebrates Thanksgiving in October, as forest industry firms in British Columbia struggled to find much to be thankful for in late November.

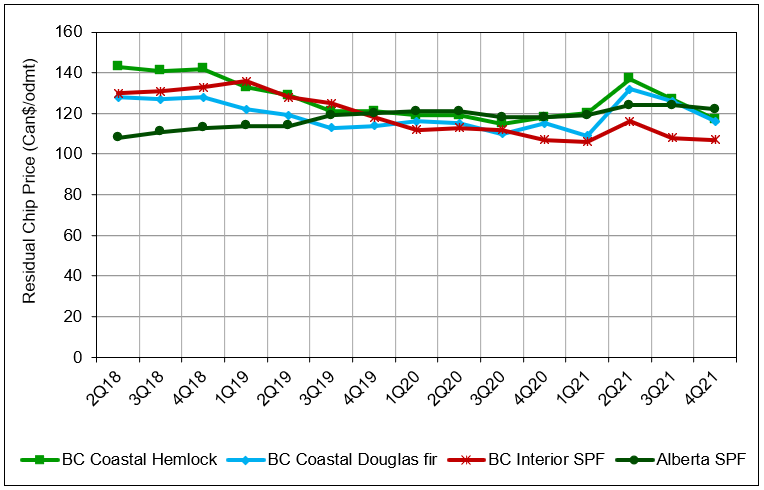

Relatively minor fiber price declines in the first half of Q4 belie the upheaval British Columbia faced as 2021 draws to a close. Formula pricing linked to NBSK market pulp prices fueled much of the 8% decline in coastal softwood chips. Despite continued high pulp prices, residual chip prices are little-changed year-over-year across BC (Figure). Interior prices also fell 1% for the quarter while Alberta SPF dropped 2%. Pulplog prices were less volatile, with Coastal Douglas-fir down 2% and Coastal Hem-fir and Interior SPF both unchanged. Pulplog supplies were in reasonable shape through mid-November.

Torrential rains severed major rail and highway links between portions of British Columbia and the rest of the country in mid-November. While repairs are being made, the disruption caused massive freight backups and shortages across the province. Two additional significant rain events further hampered operations. Pulpmills across BC reported curtailments in the face of logistics challenges in both receiving wood and shipping final products. Most major facilities reported some level of disruption. Paper Excellence’s Tiskwat mill indefinitely idled amid the challenging market conditions. While not officially closed, comments from officials indicate little likelihood of a restart.

In response to lasting protests, the British Columbia provincial government announced a two-year harvesting deferral on 2.6 million hectares of old growth forests in November. Final decision on the fate of many stands passed to First Nations tribes to accept the deferral on native lands. The announcement faced withering criticism from both First Nations tribes and the industry as neither had a voice in the initial decision. Finally, in an unfortunately-timed announcement, U.S. softwood lumber tariffs on Canadian imports doubled in late November to round out a month of dismal news. The decision would be detrimental under normal operations, but amidst supply restrictions from limited old growth removals and significant supply chain challenges, the added cost is likely to contribute to further contraction of the region’s sawmills.

Click here to learn about the Forisk Wood Fiber Review (FWFR), which has tracked pulpwood, wood chip, and biomass markets in the U.S. and Canada since 1983.

Leave a Reply