This post is the third in a series related to the Q1 2022 Forisk Research Quarterly (FRQ). It includes topics that will also be addressed in the (virtual) Applied Forest Finance course on May 19th, 2022.

Timberland-owning real estate investment trusts (timber REITs) increasingly attract interest from researchers and institutional investors. This is one finding in a study of U.S. timber REITs published by Srijana Baral and Dr. Richard Mei of the Warnell School of Forestry and Natural Resources at the University of Georgia in the Canadian Journal of Forest Research. Timber REITs continue evolve in the benefits they offer to investor portfolios interested in forest assets, tax-advantaged dividends, liquidity and ESG.

Forisk also has a strong interest in timber REITs. In 2008, we registered the FTR (“footer”) Index to track and benchmark the timber REIT sector. Each week, we publish a one-page (Forisk Timber REIT) FTR Weekly [1] that compares timber REITs to other assets. Also in 2008, we published research that analyzed stock market responses to announcements of forest industry corporations converting from traditional C-corporations to timber REITs.[2]

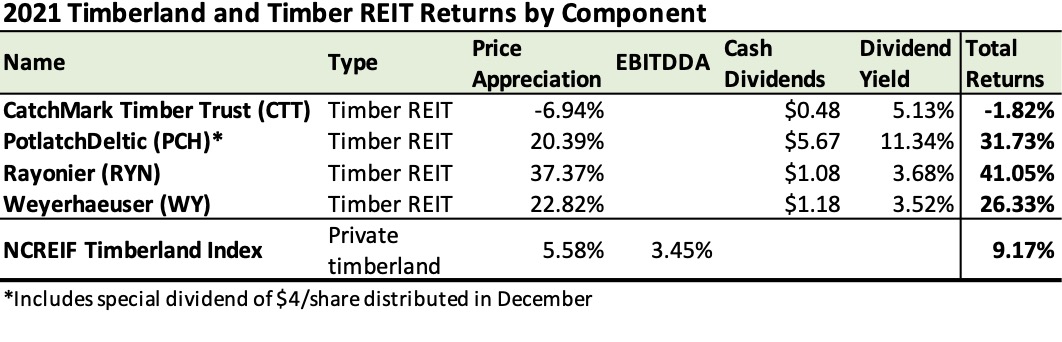

That said, how did timber REITs perform in 2021? According the FTR Weekly, timber REITs as a sector returned 25.09% based on appreciation and 30.12% on a total returns basis in 2021. How did this compare to traditional private timberlands owned by institutional investors? Timberlands returned 9.17%, the sector’s best year since 2014. The figure below compares the 2021 performance of the four public timber REITs to private timberlands as tracked by NCREIF.

The price appreciation for the timber REITs assumes investors bought shares on December 31, 2020 and sold them on December 31, 2021. The dividend yields are based on the share price upon acquisition. Absent the special dividend payment, PotlatchDeltic’s dividend yield would have been 3.34%, in line with Rayonier, Weyerhaeuser and the 3.45% earnings (EBITDDA) generated by private U.S. timberlands during the year.

[1] To subscribe to the free weekly FTR Index Summary and to obtain historical FTR Index data in an Excel format, please contact Pamela Smith, psmith@forisk.com.

[2] “Investor Responses to Timberlands Structured as Real Estate Investment Trusts” by Brooks Mendell, Neena Mishra and Tim Sydor, published in 2008 in the Journal of Forestry.

Leave a Reply