This post includes topics addressed in the (virtual) Applied Forest Finance course on May 19th, 2022 and covered in the Forisk Research Quarterly (FRQ).

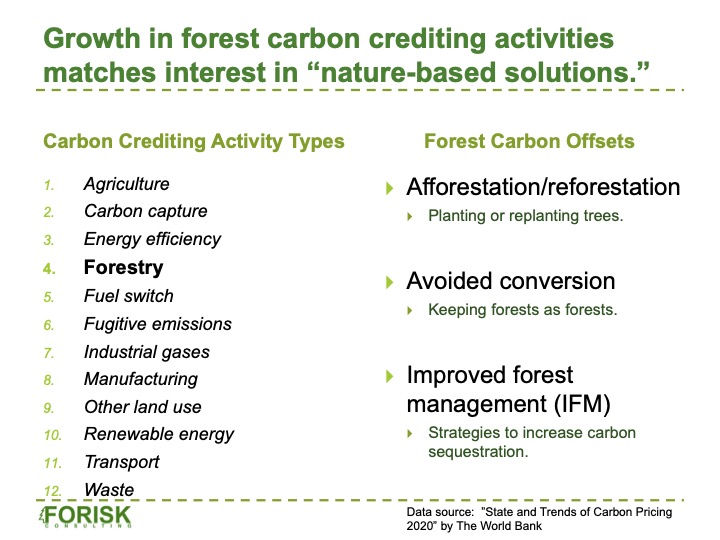

Annual reports by The World Bank on global carbon crediting trends organize the data across 12 sectors, of which forestry is one (Figure 1). From 2015 through 2019, forestry accounted for 42% of all global carbon credits issued by type, followed by renewable energy at 33%. Everyone else huddled into the remaining 25%.

Figure 1. Forest Carbon Crediting Activities

Sources: The World Bank, Applied Forest Finance

From operability and availability standpoints, forestry has been ready. Forestry CO2 projects are cheap, accessible, and ESG satisfying. Forestry provides cost-effective, nature-based solutions that keep us in the game, buying time, until bigger hitters – whether through swapped out emissions or massively scaled sequestration – prove viable and effective.

That said, a broader, portfolio view of forest carbon strategies continues to evolve. David Chandler, in a February 2022 Technology Review note, summarized recent research at MIT on optimizing, from a carbon standpoint, the use of construction materials in truss structures. The main idea works to minimize embodied carbon [something we’ve addressed previously] in construction materials, which accounts for 11% of global CO2 emissions, according to data published in The Economist (Figure 2).

Figure 2. Share of Global CO2 Emissions by Sector, %

| Buildings | 29% | Property-related, 40% |

| Construction | 11% | |

| Transport | 22% | Other, 60% |

| Industry | 29% | |

| Other | 9% |

Sources: The Economist, Green Street

Targeting the use of wood versus steel or both in trusses or other construction applications, can reduce net embodied carbon while satisfying the structural needs of trusses in different settings. While wood has a smaller carbon footprint and performs well under forces of compression (such as columns), steel may be preferred for tension (where forces pull materials apart).

In the end, forest carbon credits serve a niche role within the broader carbon market while also offering options to investors and asset owners across the forest industry.

Leave a Reply