This post is the first in a series related to the Q3 2022 Forisk Research Quarterly (FRQ), which includes forest industry analysis, timber price forecasts, and featured research on southern and Pacific Northwest timber markets.

After two scorching years, the temperature on housing activity is beginning to cool slightly. June housings starts averaged a seasonally adjusted annual rate (SAAR) of 1.559 million units. This represents a 2.0% decline from May’s numbers and a 6.3% decline year-over-year. For the quarter, starts fell 4% from Q1 to a 1.652 million SAAR.[1]

Single-family starts represent the largest source of the decline. Single-family starts fell 8.1% in June, declining for the fourth consecutive month. June’s current SAAR of 982 thousand starts represents the lowest rate in two years. Single-family permits dropped 8% as well, as high borrowing costs and persistent supply chain issues induce home builders to cut back on production.[2] A recent drop in the NAHB Housing market index may portend continued weakness in single-family construction in coming months.[3] Conversely, multifamily starts rose 15.0% in June. Multifamily permits also rose, up 11.5% to a SAAR of 718 thousand units.

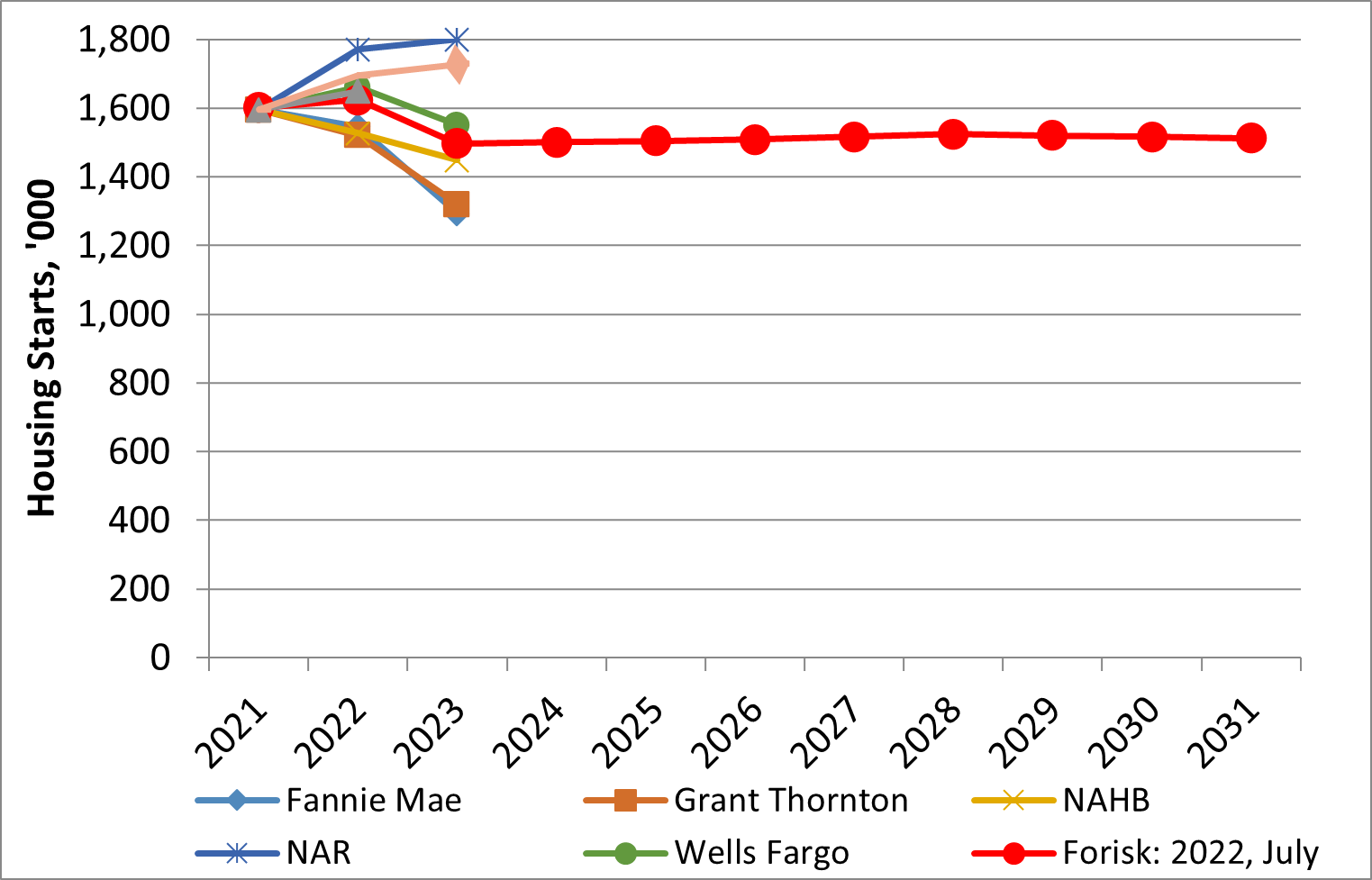

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry [4]and applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure 1).

Our latest forecast projects 2022 housing starts of 1.624 million, down -1.4% from our May forecast. We assume that underlying demand – based on demographics and household growth, second home ownership, and net replacement of existing housing stock – brings Base Case housing to a long-term trend of ~1.56 million starts. Our current forecast peaks in 2022 at 1.624 million starts before moderating in 2023. The independent housing forecasts captured in Forisk’s Housing Starts Outlook reflect the range of expectations for 2022. For example, NAR leads with a 2022 forecast of 1.78 million while Grant Thornton trails with its most recent forecast of 1.52 million. Current housing start levels are in line with the long-term average of 1.5 million and are forecast to, on average, remain so throughout the next decade. We are mindful, however, to remember the history of housing starts and expect volatility.

[1] U.S. Census Bureau (2022). U.S. Census Bureau and U.S. Department of Housing and Urban Development, New Residential Construction. Retrieved from: https://www.census.gov/construction/nrc/index.html

[2] Vitner, M & Dougherty, C. (July 19, 2022). Economics. Housing Starts Decline in June: Single-Family Pulls Back, While Multifamily Maintains Strong Momentum. Retrieved from: https://wellsfargo.bluematrix.com/links2/html/7a4b4071-8ab0-4c54-a18e-fa9773cb58fa

[3] National Association of Home Builders (July 18, 2022). NAHB/Wells Fargo Housing Market Index (HMI). Retrieved from: https://www.nahb.org/news-and-economics/housing-economics/indices/housing-market-index

[4] Currently, these include Fannie Mae, the National Association of Realtors (NAR), Grant Thornton, the National Association of Home Builders (NAHB), the Mortgage Bankers Association (MBA), PNC Financial Services Group (PNC), and Wells Fargo.

Leave a Reply