As the end of the year approaches, fiber markets remain tumultuous across North America. Slowing sawmill operations in Western Canada are exacerbating fiber shortages, as pulpmills also announce production curtailments. Meanwhile, slowing pulp production in the U.S. South places further downward pressure on fiber prices as quotas abound for logging contractors in the region.

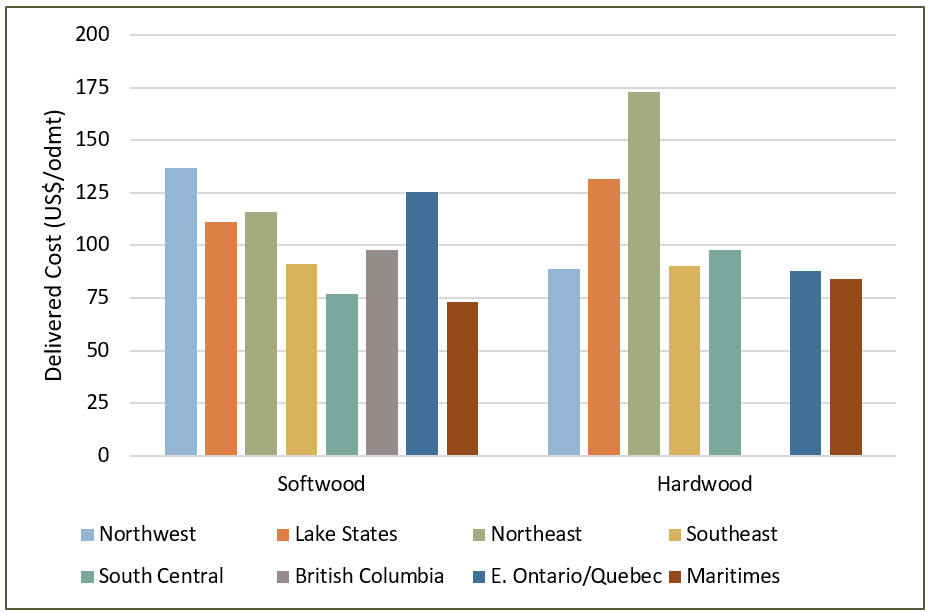

Fiber prices rose to record levels in the U.S. Northeast and U.S. West in Q4 2022. Regional differences in fiber prices are as great as they have ever been with prices for roundwood and chips varying by 100% or more on some products between the highest and lowest average cost across North American regions (See Figure). Maritimes fiber prices are among the lowest in North America, helping explain reports of chips being barged into Maine to ease record high fiber prices there. Southern fiber prices are also comparatively lower, which continues to support the shift in virgin fiber pulping capacity towards the U.S. South over the past decade.

Labor availability factored into higher prices in both the Northeast and U.S. West. A lack of logging capacity contributed to significant hardwood fiber scarcity in the Northeast, while a labor strike at Pacific Northwest Weyerhaeuser operations constrained softwood fiber availability there. The U.S. South remains a contrast as South Central prices fell for the quarter for all fiber types and Southeast prices were lower to stable. Dropping diesel prices are providing some relief to logging contractors, though fuel prices remain well above 2021 levels.

Click here to learn about the Forisk Wood Fiber Review (FWFR), which has tracked pulpwood, wood chip, and biomass markets in the U.S. and Canada since 1983.

Leave a Reply