This post is the third in a series related to the Q1 2023 Forisk Research Quarterly (FRQ) which includes forest industry analysis, timber price forecasts, and featured research on supply and demand models.

The U.S Housing market continued to contract through the close of the year. Housing starts fell again in December, marking the fourth consecutive month of declines. Seasonally adjusted starts fell 1.4% to a rate of 1.382 million starts. While single-family starts rose 11.3% since November, they were outweighed by a 18.9% decline in multifamily. For the year, total starts fell 3.0% to 1.553 million. Single family starts led the decline with an 10.6% annual drop to a pace of roughly 1.0 million. Despite the decline, 2022 housing starts represent the second highest level of housing starts since 2006.

Methodology

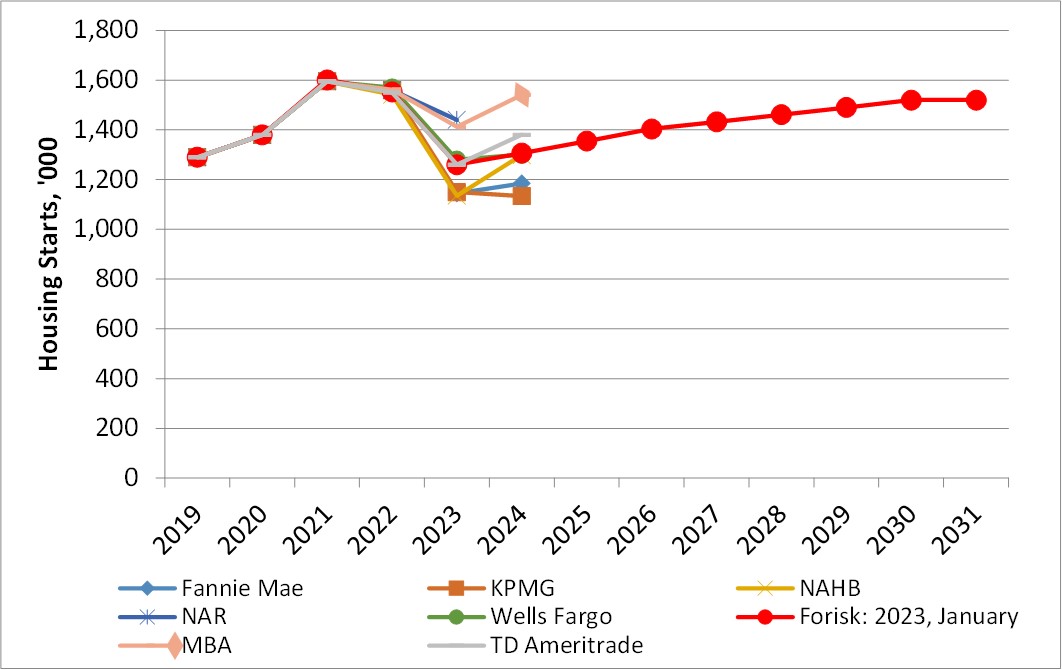

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, KPMG, the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), the National Association of Home Builders (NAHB), TD Ameritrade, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Projection

Forisk projects 2023 housing starts of 1.26 million, down 18.8% from 2022 actuals. This represents a 10.8% decline from our October 2022 estimate. High mortgage rates continue to hamper housing affordability and builder sentiment remains low. The NAHB/Wells Fargo Housing Market index, a monthly sentiment survey among builders of single-family homes, fell 57.8% year-over-year.[1] Forisk’s Base Case declines sharply in 2023 before beginning to recover. The forecast peaks at 1.52 million housing starts towards the end of the projection. Despite widespread consensus that housing starts are trending lower for 2023, estimates vary widely for 2024. For example, KPMG forecasts a bearish 2024 with an estimate of 1.134 million starts. Meanwhile, MBA posits a much more bullish 2024, rising back to 1.541 million starts. This represents a range of 407 thousand starts.

[1] https://www.nahb.org/news-and-economics/housing-economics/indices/housing-market-index

Leave a Reply