This post is the first in a series related to the Q2 2023 Forisk Research Quarterly (FRQ) which includes forest industry analysis, timber price forecasts, and featured research on western silviculture. It provides an excerpt from the forest operations chapter.

The latest Marvel blockbuster, Ant Man and the Wasp 2, features an autobiography of the main character (somehow an actual book you can buy) called “Look Out for the Little Guy”. In a sign I spend too much time thinking about work, the book reminded me of a conversation I had recently with a colleague from Maine. We were discussing Northeastern logging capacity challenges and the scale of employment decline in the Bureau of Labor Statistics (BLS) data. He reminded me of the prevalence of owner-operators in the Northeast logging industry and their omission from most BLS data. The most complete employment data comes from unemployment insurance filings, which aren’t filed for companies consisting of only one employee.

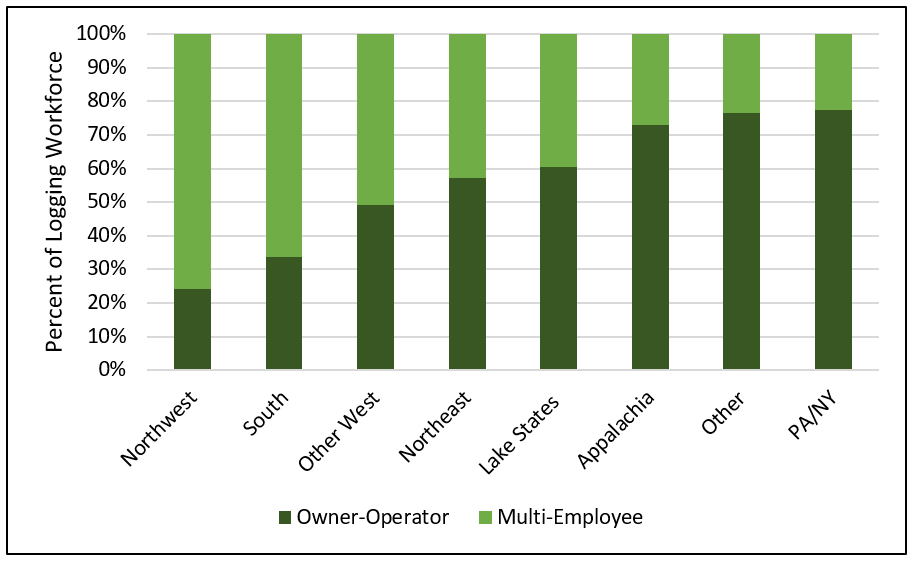

While the logging industry is shifting to larger-scale operations, it is helpful to remember the sheer number of loggers who work for themselves. The most recent data on owner-operators from the U.S. Census (covering 2019) provides a glimpse without revealing the full picture. The data include forestry and logging owner-operators, which includes consulting foresters. There are quite a few one-person consultant shops in the country, which clouds the numbers. Still, as of 2019 forestry and logging owner-operators represented 43,100 workers across the country, while multi-employee logging businesses employed 47,500. The distribution is not uniform, though, with owner-operators representing a greater proportion of logging workers in hardwood regions of the country (Figure 1).

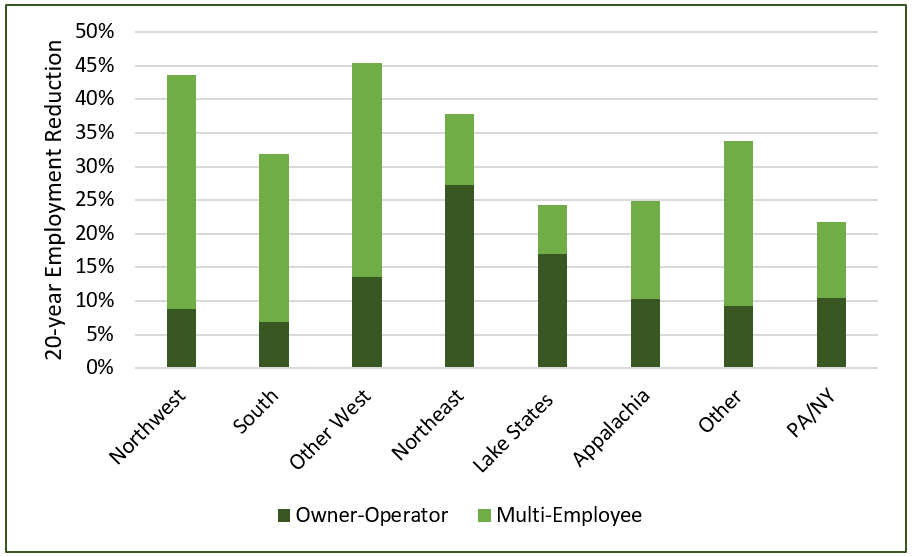

Logging capacity struggles are acute in the Northeast right now. Prices for pulpwood, in particular, doubled in areas during 2022 as mills could not secure loggers to supply sufficient volumes. Capacity shortages are causing financial harm to all sectors of the Northeast industry. Does the trajectory of owner-operators relative to multi-employee logging businesses provide any additional insights? Since 1999, total forestry and logging owner-operator employment fell 25% nationwide compared to 40% for total employment in multi-employee logging businesses. In the South and West, a higher proportion of owner-operators are likely consultants, given the shift to high-production operations. The drop in multi-employee businesses in those regions represented 80% of the total drop in logging employment over the last twenty years (Figure 2). In the Northeast, though, owner-operator businesses dropped by over 40% in twenty years, representing close to 70% of the total change in logging employment since 1999. Sadly, multi-employee businesses did not fare much better dropping over 30%[1], but owner-operators were a larger segment of the workforce.

As the industry seeks efficiency and productivity, scale matters. Larger, mechanized logging operations lower per unit costs by moving more wood volumes. Owner-operators fill a critical niche in the industry, particularly for small landowners and in hardwood regions. As we contemplate the future of logging and where growth may occur, it does help to “Look Out for the Little Guy”. They may not always be there for us.

To learn more about the Forisk Research Quarterly (FRQ), click here or call Forisk at 770.725.8447.

[1] Conditions haven’t improved since 2019. Northeast logging businesses trimmed an additional 5% through Q2 2022. Data on owner-operators isn’t available.

Leave a Reply