This post is the second in a series related to the Q2 2023 Forisk Research Quarterly (FRQ) which includes forest industry analysis, timber price forecasts, and featured research on western silviculture. It provides an excerpt from the U.S. South regional summary, which includes timber price, demand, and supply outlooks by state.

Private timberland owners, including timber investors, public timberland companies, forest industry, and individuals/families, own 4.4 billion tons of standing pine timber in the U.S. South. The timber inventory consists of 2.7 billion tons (62%) of sawtimber and 1.7 billion tons of pulpwood (38%). Every year, we update our forecasts of timber supplies in the U.S. South. The forecasts inform the timber price models published in the Forisk Research Quarterly and they give us a view of the future to use for capital investment decisions.

Updated models forecast the pine inventory in the South to increase 9% in the next ten years. Supply forecasts project more inventory growth than our models last year due to higher inventories and timber growth/acre as measured by the U.S. Forest Service and lower expectations of demand from a lower housing outlook. Results vary by state. Pine inventories decline in Florida, Georgia, and Louisiana. Inventories increase in the other Southern states, with the largest inventory increases by volume in Mississippi, Arkansas, Virginia, and Alabama. Results also vary by product: pine sawtimber inventories increase 17% in the South in ten years, while pulpwood declines 3%.

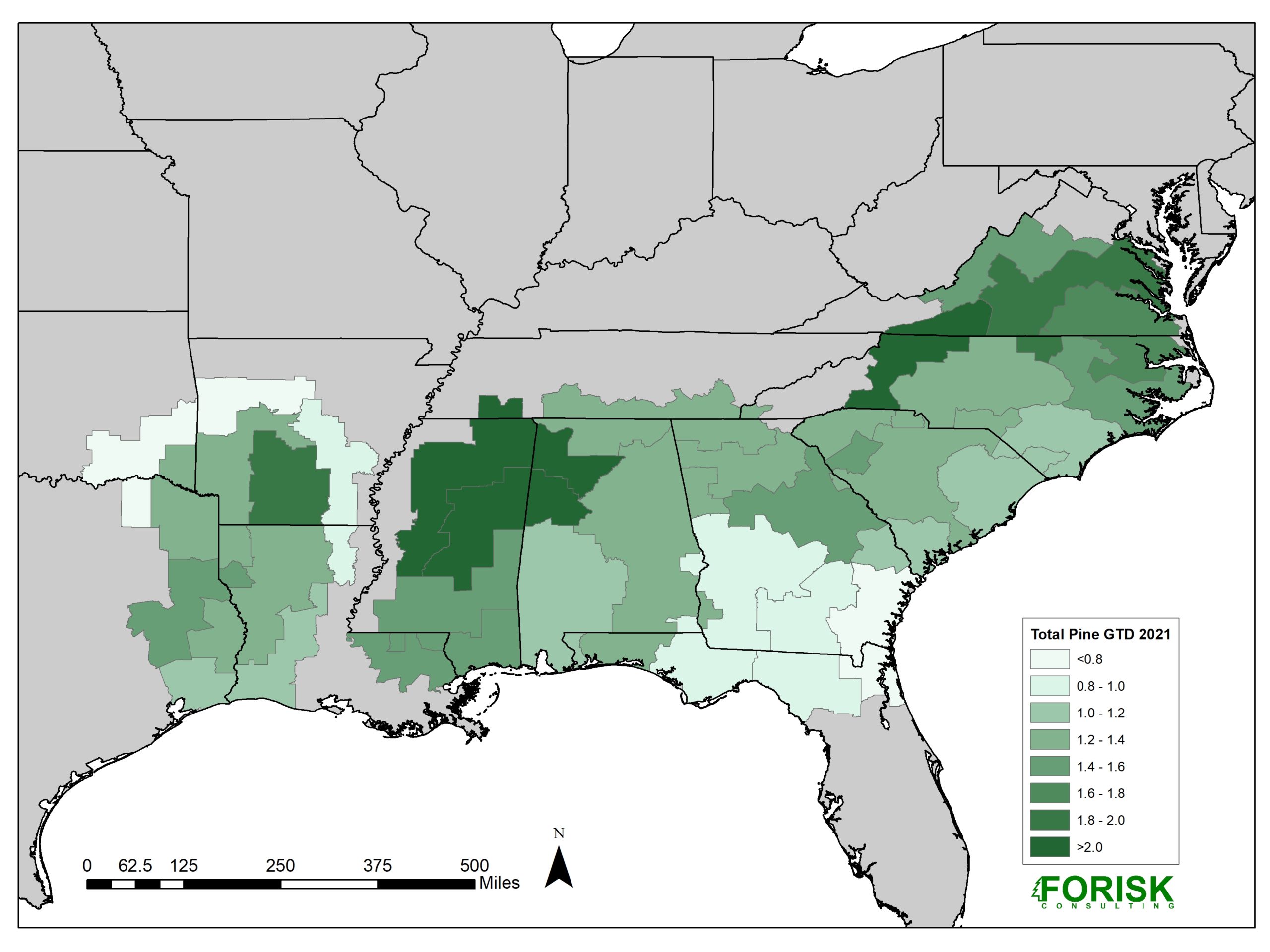

While state-level models are helpful for regional analyses, timber markets are local. Strategic decisions on where to build mills or where to buy timberland rely on market-specific analysis. The 2022 Timber Market Rankings Study that we published last year analyzed 30 timber markets in the U.S. South and 7 markets in the Pacific Northwest to rank them for investment. Growth-to-drain analysis from this report shows localized supply dynamics that provide more nuance than the state-level trends. For example, markets in southern Georgia show tightness in supply relative to demand. This contrasts the more plentiful timber supplies in north Georgia relative to demand in that part of the state. Likewise, localized analysis shows more of a supply imbalance in northern Mississippi than in southern Mississippi.

Timber supply forecasts indicate opportunities for wood-users to expand in the U.S. South, and they inform strategies of timberland investors to manage portfolios in the region.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Heather Clark at hsclark@forisk.com.

Leave a Reply