This post is the second in a series related to the Q3 2023 Forisk Research Quarterly (FRQ) which includes forest industry analysis, timber price projections, and featured research on scenarios for forecasting timber prices.

The housing sector rebounded over the quarter, largely a function of robust May numbers. Although, starts since declined in June, with seasonally adjusted values down 8.0% over the month. Current starts constitute a 1.434-million-unit pace. While down from May, this still represents a 4% increase from March’s numbers.

Total starts rose 4.5% over the quarter to a 1.45-million-unit average rate. Likewise, single family starts rose 11.4% to a 929-thousand-unit average pace. Meanwhile, multifamily fell 5.8% to a 505-thousand-unit rate. Single-family starts represented an average of 68% of total U.S housing starts over the past decade.

Methodology

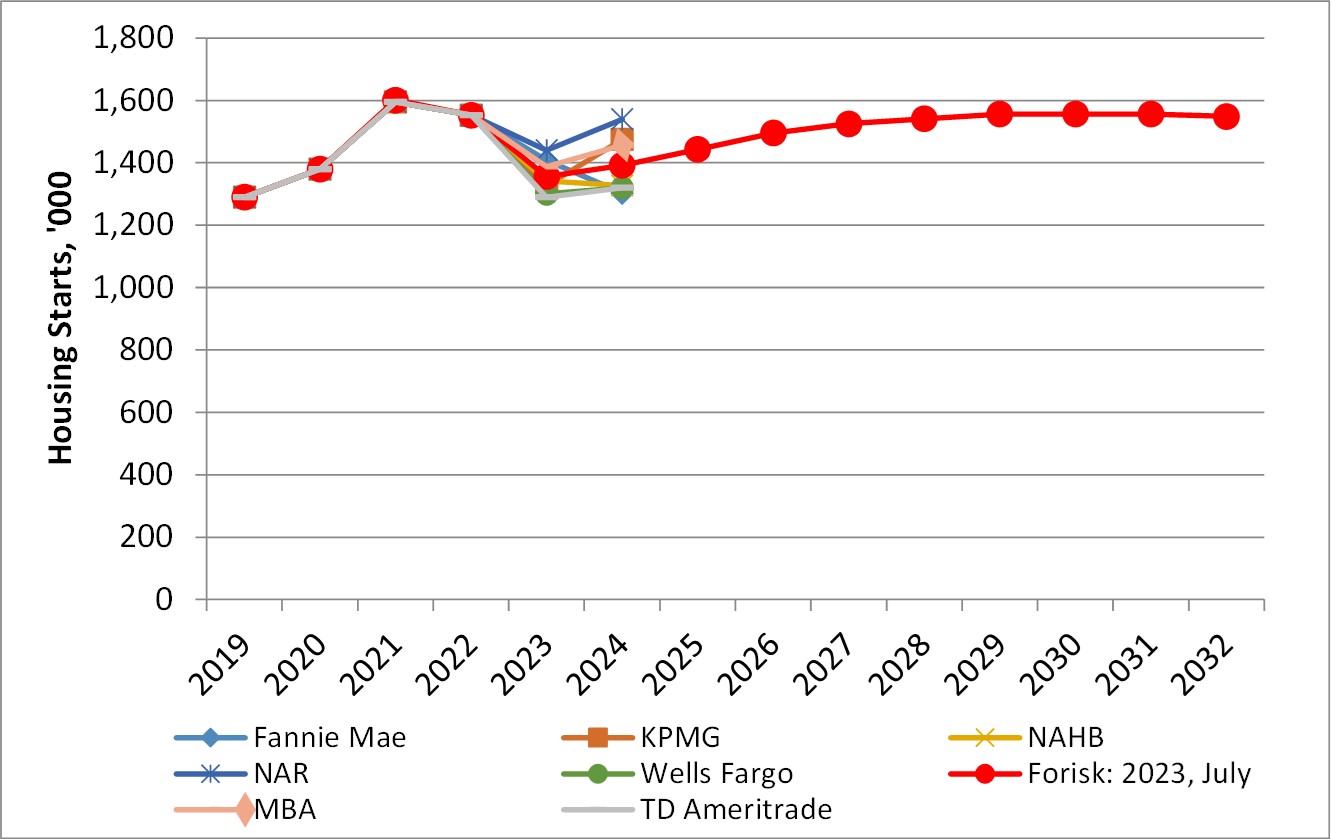

Each quarter when updating our Forisk Research Quarterly (FRQ) forecast models, we revisit prior projections and review applied research on business and economic forecasting. Forisk’s Housing Starts Outlook combines independent forecasts from professionals in the housing industry. Currently, these include Fannie Mae, KPMG, the National Association of Realtors (NAR), the Mortgage Bankers Association (MBA), the National Association of Home Builders (NAHB), TD Ameritrade, and Wells Fargo. Forisk applies long-term assumptions from the U.S. Energy Information Administration (EIA) and Harvard’s Joint Center for Housing Studies to establish the peak and trend over the next ten years (Figure).

Projection

Forisk projects 2023 housing starts of 1.356 million, down 12.7% from 2022 actuals. This represents a 6.6% increase from our May 2023 estimate. Despite a rate induced slow-down in housing activity in mid-2022, supply remains constrained. Monthly supply of new homes for sale peaked at 10.1 in July of last year. However, since then, supply fell steadily, down to 6.7 months as of May 2023.[1] Tight supply of housing will likely keep pressure on home prices, despite increased interest rates.

Forisk’s Base Case declines sharply in 2023 before beginning to recover. The forecast peaks at 1.56 million housing starts towards the end of the projection. Despite widespread consensus that housing starts are trending lower for 2023, estimates vary widely for 2024. For example, Fannie Mae forecasts a bearish 2024 with an estimate of 1.303 million starts. Meanwhile, NAR posits a much more bullish 2024, rising back to 1.540 million starts. This represents a range of 237 thousand starts.

[1] The months’ supply is the ratio of new houses for sale to new houses sold. This statistic provides an indication of the size of the new for-sale inventory in relation to the number of new houses currently being sold. The months’ supply indicates how long the current new for-sale inventory would last given the current sales rate if no additional new houses were built. Available at: https://fred.stlouisfed.org/series/MSACSR.

Leave a Reply