This post is the third in a series related to the Q3 2023 Forisk Research Quarterly (FRQ) which includes forest industry analysis, timber price projections, and featured research on scenarios for forecasting timber prices.

An old Ray Charles song uses one of the many iterations of the phrase, “If it wasn’t for bad luck, I’d have no luck at all.” The saying feels regrettably fitting for the logging sector of late. Over the last two years, inflation stressed contractors with higher logging costs. A recent cooling of lumber markets amid continued slow paper demand forced production quotas on many loggers, as well. Low margins and constrained production are a financially damaging mix. Historically, logging employment declines in response to reduced wood demand. Data from the Bureau of Labor Statistics shows that a four-quarter moving average of U.S. South logging employment declined 13 consecutive quarters through the end of 2022. Despite the recent slowdown in lumber, southern wood demand did not decline over the last 13 quarters. Harvest levels in 2022 exceeded those in 2005, prior to the Great Recession. Western logging employment fell 3% year-over-year in 2022, but the decline has not been as consistent as in the South.

State-level Logging Employment Trends

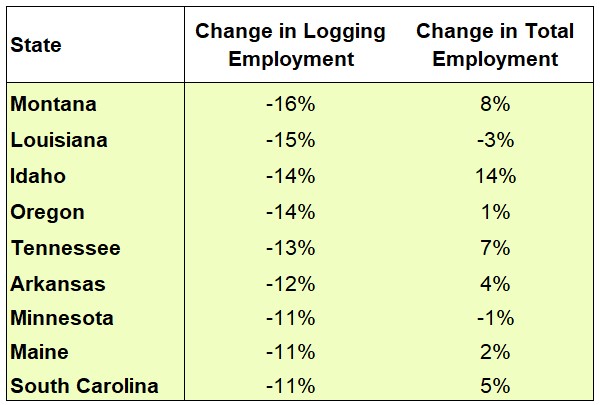

Looking beyond national trends, there are 23 states in the U.S. with at least 100 logging businesses headquartered in them. Out of those 23 states, only two increased logging employment between 2018 and 2022, Pennsylvania (+4%) and Texas (+6%). Of the remaining 21, nine recorded logging employment declines greater than 10% (Figure). Montana and Idaho are two of the top three, each losing more than 14% of their logging force as wood demand fell in the region. Louisiana recorded the second greatest drop in logging employment (15%), likely influenced by the closure of Georgia Pacific’s Port Hudson pulp mill. Oregon also recorded a 14% decline. Four sawmills closed in Oregon between 2018 and 2020.

Total employment increased in seven of the nine states, indicating logging employment fell while the workforce in most states rose. Louisiana again stands out as an exception, highlighting general labor concerns there. With substantial investments in sawmill and bioenergy capacity over the last three years, Louisiana wood demand could increase as much as 30% over the next decade. Shrinking harvesting capacity should be a concern.

Leave a Reply