This post is the fourth in a series related to the Q3 2023 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America.

As they grow, trees absorb carbon dioxide from the atmosphere. This capturing of “forest carbon” is one modest part of a major transformation in how we produce and source energy. In this shift from fossil fuels towards renewables and conservation, each piece, as a standalone, does not specify or dictate a known energy future. Rather, everything supports a process of continuously upgrading the planet’s energy portfolio.

A portfolio framework for forest carbon resonates for investors. Just as we might improve a timberland investment portfolio by pruning the lowest performing assets and adding more profitable alternatives, we ambitiously work to raise the average performance and reduce the negative externalities of industrial activities and power generation. There are no “silver bullets” in this story.

However, forest carbon markets are not without their critics or challenges. Forest carbon, as with the advocacy of forest biomass as a renewable energy source, faces continued scrutiny[1]. This leads to uncertainty for timberland investors. Two speakers at the 2023 Forest Landowner Association’s National Conference in June in Nashville addressed this directly, providing helpful context and resources for forest owners.

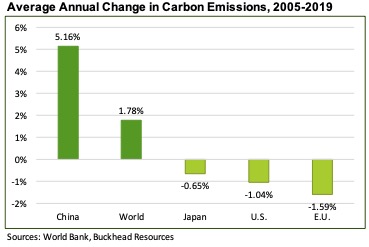

Richard Hall of Buckhead Resources emphasized the importance of the ability to measure baselines and change as a means of tracking performance and determining units of value. In addressing the question “Do forest carbon markets work?”, he shared data from 2005 through 2019 that showed the average annual change for multiple geographies (Figure). In short, trading systems, especially in the European Union, do affect behavior. He noted, “there is continued interest in forest carbon markets, so forest owners could benefit by having a working knowledge of their own carbon resources and the market options available to them.”

Professor Melissa Kreye of Penn State followed with more helpful context, noting that most forest carbon (~95%) is in standing trees, versus wood products. In addition, the major benefit of forest carbon efforts comes through wood products displacing other materials, such as steel. Thinking in terms of the overall portfolio, forest carbon markets are largely based on averages, with the goal of raising the average forest age, forest inventory, forest coverage, and the average use of wood relative to other building products.[2] We succeed by improving each one of these on the margin over time.

#

[1] See “The Core Carbon Principles Assessment Framework” as an example of how the sector is addressing this. Available at: https://icvcm.org/assessment-framework/

[2] For helpful forest carbon resources, visit Penn State Extension site with Resources for Family Forest Owners: https://extension.psu.edu/resources-for-family-forest-owners-carbon-markets-and-climate-smart-forestry

Leave a Reply