This blog includes data from the Forisk Wood Fiber Review, a quarterly publication tracking North America’s major wood fiber markets. For more information, please visit www.forisk.com.

Usually, at least one market in the forest industry is hot: lumber, paper, packaging, veneer, specialty markets… something. However, the slowdown that began a year ago included all those markets, with some trending downward before 2022.

The difference is apparent to industry professionals across North America. “Typically, there is one bright spot that we can focus on,” reported an Operations Manager in the Pacific Northwest. It says much about the state of the industry that people are looking for any bright spot, even if it is one that positively affects another company’s bottom line.

Fiber Prices Down Across North America

Residual chip and roundwood prices stayed flat or decreased in all regions across North America except for the US Northeast, where the wettest summer on record precipitated difficult logging conditions and double-digit percentage increases of softwood and hardwood roundwood prices.

A month-long port strike in British Columbia caused a transportation backup that included trucking and rail issues. At least one mill shut off all fiber deliveries citing the strike as the cause. With demand falling, prices followed suit.

Fiber Inventories at Capacity

Fiber inventories are at or near, record highs across the U.S., with many suppliers on quotas. In the U.S. Northwest, WestRock’s Tacoma, Washington mill ceased operations recently, which means there will be more fiber available without a home. Near-perfect summer logging conditions in the Lake States means that some of the 2022 winter-only forest jobs that were skipped due to warm temperatures late in the year were harvested. However, much of that fiber remains in the woods, roadside, waiting to be delivered when quotas are off.

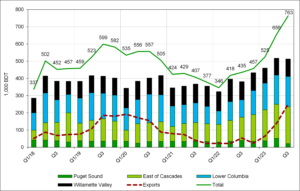

The figure below shows woodchip inventories at pulp mills in the U.S. Northwest. Near record levels of domestic inventories, along with high export inventories shows that the glut is real.

Leave a Reply