This post includes data from Forisk’s North American Timberland Transactions Database and research from the Forisk Research Quarterly.

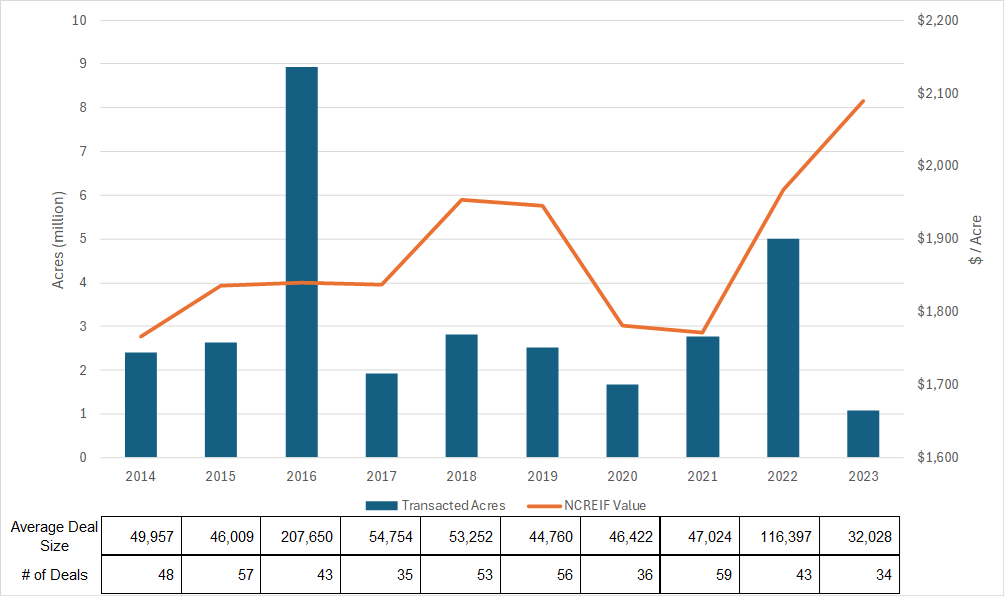

2023 was a down year for timberland transactions in the U.S. and Canada, with just over a million acres trading, well below the two to two and half million acres range that has been the norm since Forisk started tracking transactions. Was this an anomaly or a sign of what’s to come? Only time will tell, but a few observations can be made by looking at the historical data.

The figure above shows total acres transacted by year from Forisk’s Timberland Transaction database along with the implied per acre value of timberland from the NCREIF Timberland Index. The 2016 data includes 6.3 million acres from the Weyerhaeuser/Plum Creek merger, which distorts the normal trend. Additionally, the 2022 data includes The Forestland Group’s sale of 1.7 million acres to Blue Source Sustainable Forests (now Aurora Sustainable Lands) as well as The Ontario Teachers’ Pension’s redemption transaction of 870,000 acres from Resource Management Services.

So, what can we glean from the data?

- The pace of timberland transactions is inconsistent and often skewed by large deals in a given year.

- Timberland transactions can take a long time to be completed and the timing can be impacted by numerous factors, often moving closing dates by several months.

- The precipitous rise in timberland values, as tracked by the NCREIF Timberland Index has likely given buyers some pause when it comes to large deals.

Overall, these observations are consistent with what we hear from clients and industry sources. 2022 was a big year, so the dip in 2023 wasn’t necessarily alarming. The high valuations are leading buyers to proceed cautiously, though there does seem to be adequate capital searching for deals. Finally, a number of significant transactions are currently pending, indicating that transaction volume will likely rebound in 2024.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Lumber prices are down, discount rates are high, housing is stagnant. Alternatives to timberland are enticing. Why would timberland prices be high?

Good question Sam. It certainly varies by investor, but seems to be a combination of inflationary fears, ESG standards, and global unrest leading investors to seek out low risk, real assets.