This blog includes data from the Forisk Wood Fiber Review, a quarterly publication tracking North America’s major wood fiber markets. For more information, please visit www.forisk.com or contact Nick DiLuzio at ndiluzio@forisk.com.

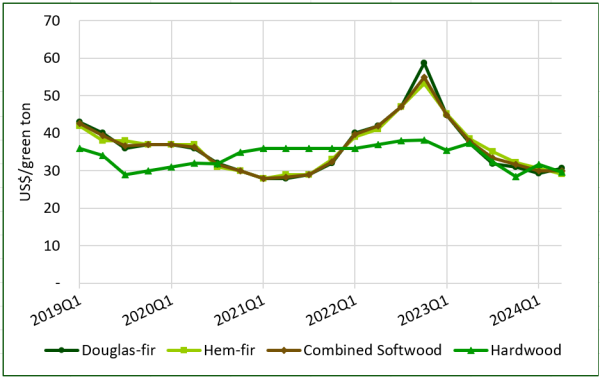

The slight increase in Douglas fir pulplog prices in Q2 2024 is not enough to offset the overall declining trend of prices returning to the historical mean after the recent peak of Q4 2022, when prices reached mid-$50/green ton due to scarce supply.

One possible factor contributing to the shortage of pulplogs in Q4 2022 was the advancement of sawmill technology that makes it possible to utilize smaller diameter logs once used only for pulpwood. Lumber markets were much more profitable throughout 2022 which saw the demand for all logs increase. This made it very difficult for softwood pulpwood consumers to find accessible fiber.

As 2023 began, the story quickly changed. The abundance of softwood pulpwood available on the market soared, while the price plummeted. As the lumber markets declined, sawmill production slowed dramatically and very few logs were purchased, let alone the small diameter logs previously only used for pulpwood. Soon the pulplog market was so flooded that there were reports of pulplogs being burned in the woods.

Mill closures and curtailments in the second half of 2023 continued into 2024 with six Pacific Northwest (PNW) sawmill closure announcements in the first quarter alone. The demand for pulpwood waned as whole-log chipping operations have slowed significantly since 2022. Consumers are purchasing more residual chips, when possible, as the more economical choice.

Hardwood pulplog prices have stayed much more consistent over the last few years, mainly because the supply and demand are on a much smaller scale in the region, compared to softwood pulpwood.

As new wood-consuming mills come online in 2025 and 2026, the industry in the PNW will continue to change and evolve. The planned additions include a new pellet production facility in Longview, Washington, and a new MDF (medium density fiberboard) plant in Dillard, Oregon.

Leave a Reply