A high interest rate environment has supported lowered expectations for housing starts this year. Seven of eight independently published forecasts revised their 2024 view of U.S. housing starts downward since last quarter, as inflation readings this year have remained above the Federal Reserve’s 2% Y/Y target. While inflation is slowing, the Federal Reserve remains steadfast in its goal to lower inflation and, as a result, mortgage rates reached 23-year highs of 7.0% throughout Q2 (and an average of 6.9% month to date). This post reviews Forisk’s updated forecast on housing starts over the next 10 years in light of these revisions, the projected pathway of monetary policy, and the structural conditions of the U.S. housing market.

Methodology

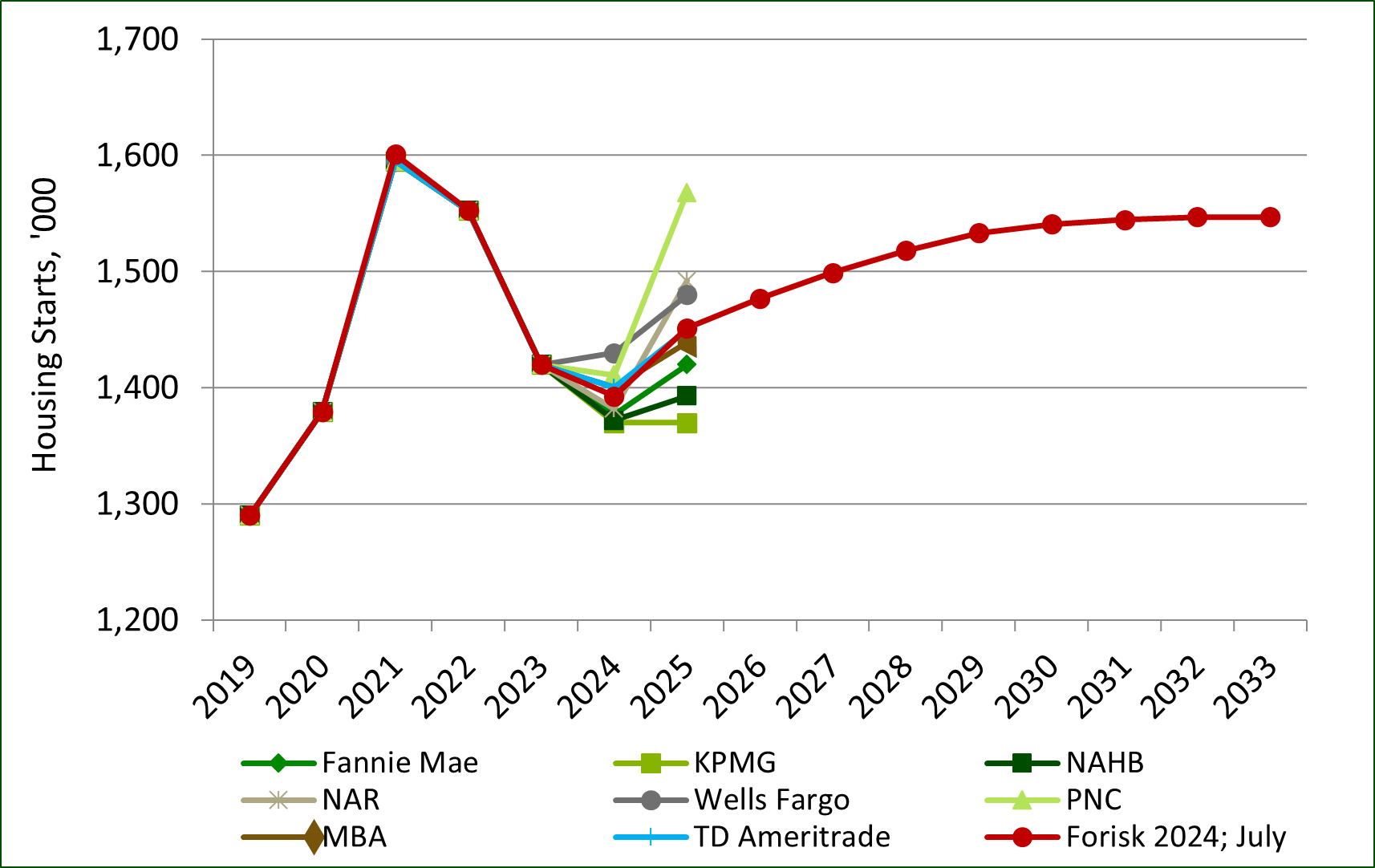

To inform our outlook of housing starts, Forisk first reviewed forecasts published by eight independent financial institutions with exposure to the housing market. The figure below lists these institutions. We combine these outlooks to provide our near-term view of annual housing starts (2024-2025). This allows for any bias contained in one or more of the forecasts to weigh against the others. It also aggregates the decentralized knowledge of active participants in the housing market to inform our view.

For our longer-term outlook (2026-2033), we evaluate structural conditions to determine shifts in the supply and demand of new homes. These include: 1) the household formation rate, 2) the second home ownership rate, 3) the annual replacement rate of the existing housing inventory, and 4) the household vacancy rate.

For the household formation rate, we look to the projected U.S. household growth rate through 2035 reported by Harvard’s Joint Center for Housing Studies (JCHS). Based on this forecast, adjusted for observed forecast errors from the 2018 JCHS report, we expect household growth to increase by 1.17 million units per year. While some analysts suggest the household formation rate is overestimated, the general consensus is that the U.S. is in a housing shortage. We expect this shortage to drive increases in annual housing starts from 2026 through 2032. After adjusting for home vacancy rates, second home ownership rates, and the net replacement rate of the existing housing inventory, we forecast 15.1 million housing starts through 2033.

Data Sources: Fannie Mae, KPMG, Mortgage Bankers Association (MBA), National Association of Home Builders (NAHB), National Association of Realtors (NAR), TD Ameritrade, Wells Fargo.

Projection

The Forisk outlook projects single- and multi-family housing starts in 2024 will total 1.393 million units, reflecting a 1.9% decrease from 2023 housing starts. Our view projects a rebound in 2025 to 1.452 million units, reflecting an easing monetary policy outlook and a growing household formation rate. While year-to-date single-family housing starts are higher this year through June than they were last year, multi-family starts have struggled to keep pace with last year’s activity. Many expect the Federal Reserve to cut rates during the latter half of 2024. This could alleviate the sluggish growth observed in the multi-family market so far this year. However, the potential for persistent inflation to slow the anticipated pace of rate cuts remains a risk to the housing sector through at least 2025.

This post reports on Forisk’s Base case housing scenario for the Q3 2024 Forisk Research Quarterly (FRQ). To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com) or Heather Clark (hsclark@forisk.com).

Leave a Reply