“Nothing travels faster than the speed of light, with the possible exception of bad news, which obeys its own special laws.” – Douglas Adams

While attending a recent forestry meeting, I received a text message about more sawmills closing due to poor markets. The disappointment and compassion for those affected is always my first reaction. Amazement that everyone was already discussing these new closures as a well known fact shocked me more than it should. Our industry is comparatively small and the relationships we share tend to be strong. Information flows so quickly and it can be hard to provide context when the next announcement is already coming towards you.

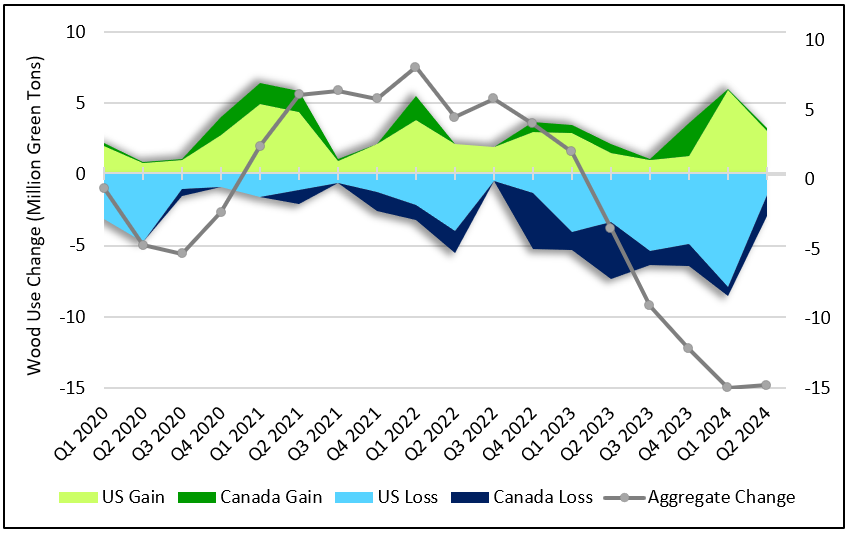

Forisk tracks all public mill investment and divestment announcements for the North American forest industry. An analysis of these announcements over the past 18 quarters documents the shifts in wood demand. North America’s wood-consuming capacity contracted by 15 million green tons since the start of 2020 (Figure). The balance of increases, through new and expanded mills, and contraction through closures and curtailments varied across time and regions. As COVID forced closures in early 2020, total capacity shrank. The industry rebounded quickly, though, and through Q1 2022, the industry increased net wood-consuming capacity by 8 million green tons compared to the start of 2020. In the eight quarters that followed, capacity contracted by 23 million green tons across Canada and the U.S. While the U.S. consistently outpaced Canada in the scale of changes, both countries demonstrated net growth after the first eight quarters, followed by contraction over the following eight quarters.

Regional and Sector Trends

Regionally, the U.S. South added nearly 5 million net tons of wood-consuming capacity while Western Canada lost 10 million tons. The U.S. South both lost and gained more wood-using capacity than any other region. Despite losing 34 million tons of capacity, the South added 39 million tons to net 5 million more tons of wood use since the start of 2020. In contrast, Western Canada lost 17 million tons of wood use and added 7 million tons. Both the U.S. North (-7 million tons) and West (-4.5 million tons) also suffered net declines. Eastern Canada was the only other region with a net increase in wood-using capacity (1.5 million tons).

The 7 million tons of wood-using capacity lost from the U.S. varied widely by sector. The lumber and paper sectors are the largest current and historic wood users and drove most of the capacity variation since 2020. In aggregate, lumber facilities contributed 13 million net additional tons, the largest growth sector, while wood pellets (6 million tons) and OSB and other wood panels (2 million tons) also increased. Contractions and closures in the pulp and paper industry represented a 27-million-ton net reduction in wood-using capacity. Combined heat and power plants closed in conjunction with many affiliated paper mills, contributing to a further loss in wood-using capacity amongst other bioenergy facilities.

This post contains an excerpt from the Q3 2024 Forisk Research Quarterly (FRQ), which includes forest industry analysis and timber price forecasts for North America. To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply