U.S. wood pellet production facilities can be classified into two categories: “industrial grade,” which is mostly produced in the South and “domestic use grade,” which is primarily produced in the East and West. In addition to different end uses, the two categories of pellet producers operate differently. For industrial grade pellets, a vast majority are pre-sold under long term take-or-pay contracts, while domestic producers operate more at the mercy of the prevailing market prices, so operating rates tend to fluctuate more in the East and West. When domestic grade pellet prices are high, operating rates increase. When they are low, domestic grade producers pull back production by running facilities at operating rates lower than their full capacity. This reflects how domestic grade producers operate more directly in competitive spot market conditions, so are “price-takers”.

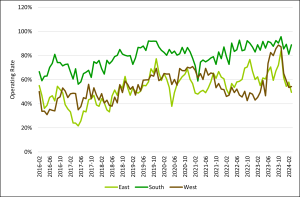

Using data provided by the Energy Information Administration (EIA), this increasing stability in industrial grade pellet markets is borne out when observing the regional operating rates. Operating rates measure the amount of product actually produced divided by the rated capacity or “nameplate” capacity. Since 2016, the U.S. South operating rate averaged 89% in the last twelve months, significantly higher than the other two regions. Southern manufacturers seem to have improved their operations as the industry matured, with the average yearly operating rate increasing from 60% in 2016 to 90% in 2023. The Western and Eastern region monthly operating rates since 2016 averaged 54% and 53%, respectively. For the last 12 months, those two regions averaged 69% and 63% operating rates.

Leave a Reply