Introduction

Since last quarter, housing markets remained sluggish amidst falling inflation and a slowdown in labor markets. While the federal reserve lowered its policy rate last month to support labor market conditions, the realization of this policy change in the housing sector has taken longer to develop. Starts during Q3 2024 were the lowest for a third quarter since 2019, down 3.5% from Q3 2023 and down 5.0% from Q2 2024. As a result, several forecasters revised their year-end outlook on U.S. housing starts further downward since last quarter but retained their view of a rebound in 2025.

Recent revisions to the 2024 outlook

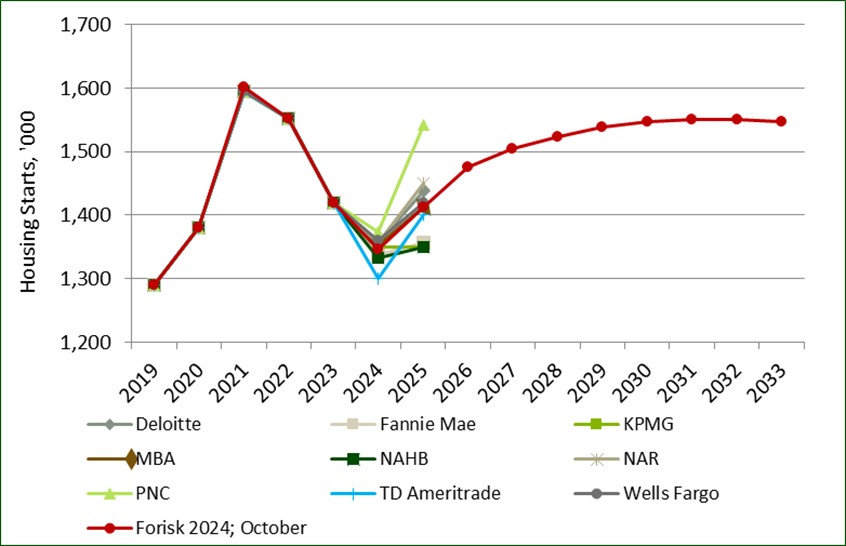

We leveraged nine independently published forecasts of U.S. housing starts to inform our near-term outlook. Since last quarter, all nine sources revised their 2024 outlook downward. We incorporated Deloitte’s economic forecast into our view this quarter, which raises our compiled 2024 forecast from 1.346 million units to 1.347 million units. TD Ameritrade maintains the lowest forecast for 2024 at 1.300 million units, while PNC Bank maintains the highest forecast of 1.374 million units. Year-to-date starts through Q3 totaled 1.043 million units, so our updated 2024 forecast suggests there will be an additional 304 thousand units during Q4.

Figure: Q4 2024 Forecast of U.S. Housing Starts

Data sources: Deloitte, Fannie Mae, KPMG, Mortgage Bankers Association (MBA), National Association of Home Builders (NAHB), National Association of Realtors (NAR), TD Ameritrade, Wells Fargo.

2025 and beyond

We revised our outlook for 2025 starts downward from last quarter by 2.7%, from 1.452 million units to 1.413 million units. While lower than last quarter, we still maintain our view of a 2025 rebound in annual housing starts, reflecting the expected path of interest rates through next year. Beyond 2025, we expect structural shortages in the housing market to stimulate investment in new housing inventory. We project there to be a total of 15 million housing starts from 2024-2033, with the pace of new homes growing at a compounded annualized pace of 1.6% per year. We currently expect a peak in annual starts in 2031 and 2032 at 1.550 million units per year.

This post reports on Forisk’s Base case housing scenario for the Q4 2024 Forisk Research Quarterly (FRQ). To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

Leave a Reply