Prepared by: Thomas Black, Forisk Intern

Southern softwood sawmills invested heavily over the past 10-15 years to gain efficiency. Lumber conversion rates, also known as recovery rates, overrun, or underrun, represent a ratio of tons of feedstock consumed to produce one thousand board feet (MBF) of lumber. The recovery factor represents, in percentage terms, the proportion of the log that can be cut into lumber. Thus, efficiency yields a lower conversion rate and higher recovery factor. Forisk spoke with 14 companies, gathering data on sawmills to discuss their conversion rates and determinants that affect open and operating U.S. southern softwood sawmills. Southeastern U.S. mills were aggregated into groups based on name plate capacity: from under 50 MMBF to over 200 MMBF.

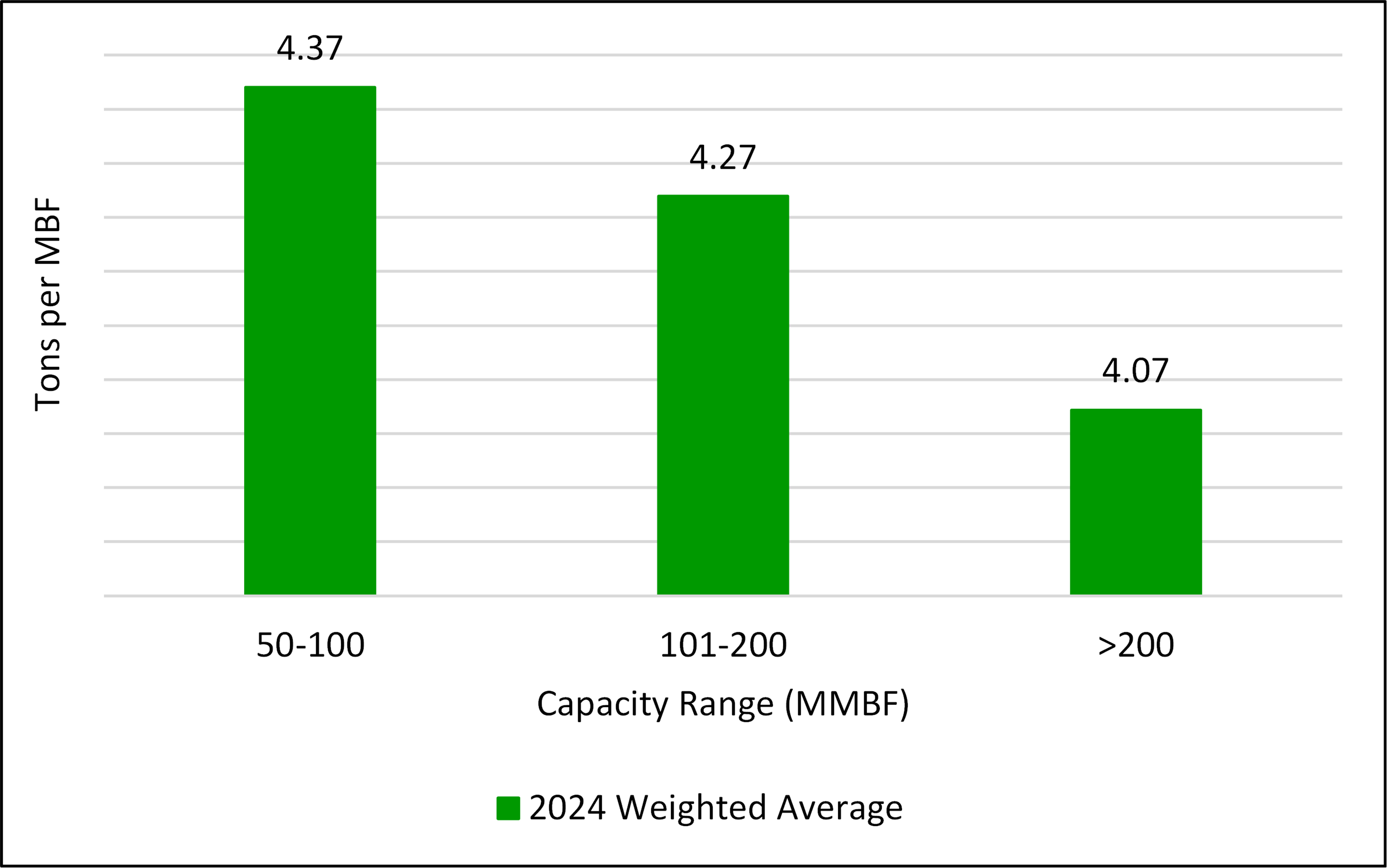

Data was collected via phone interviews with representatives from companies closely familiar with their sawmill operations across the Southeast. The representatives spoke directly about 38 total facilities, comprising approximately 23% of the total pine grade wood use (tons) in the southeast per Forisk North American Forest Industry Capacity Database. Each interview followed the same questions, focusing on each facility’s feedstock species, feedstock specifications, end products, conversion rates, and recent capital expenditures. Based on our survey, the weighted average conversion rate for southeastern sawmills with capacities of 50 to 100 MMBF, 101 to 200 MMBF, and greater than 200 MMBF are 4.37, 4.27, and 4.07 tons per MBF, respectively.

Data Source: Forisk

Conversion rates have improved since 2019 for all mill sizes, with 50 to 100 MMBF mills improving most, a 13% reduction in tons per thousand board feet (MBF). Still, a larger sawmill in the South produces 1 MBF of lumber with 7% less raw material than a smaller mill, a significant savings.

Southern yellow pine lumber recovery rates are strongly correlated to diameter, taper and quality. High quality, large diameter logs contribute to higher yields and a greater recovery factor. Small diameter logs and significant taper have the opposite effect, creating more waste in converting the log to lumber. End product type also has an impact; for example, boards (1×4-12s) generate more waste due to additional cuts and saw kerf, which leads to higher conversion rates compared to dimensional lumber. Capital investments in sawmills are largely focused on upgrading to current technology to maximize yield. Artificial intelligence and machine learning can optimize cutting patterns and maintenance requirements. Advanced scanning and imaging technologies optimize yield extraction, minimizing waste and improving recovery. Firms make investments to maximize benefits and minimize costs, seeking to generate margin from production efficiency and sustainability above the associated costs to complete capital projects.

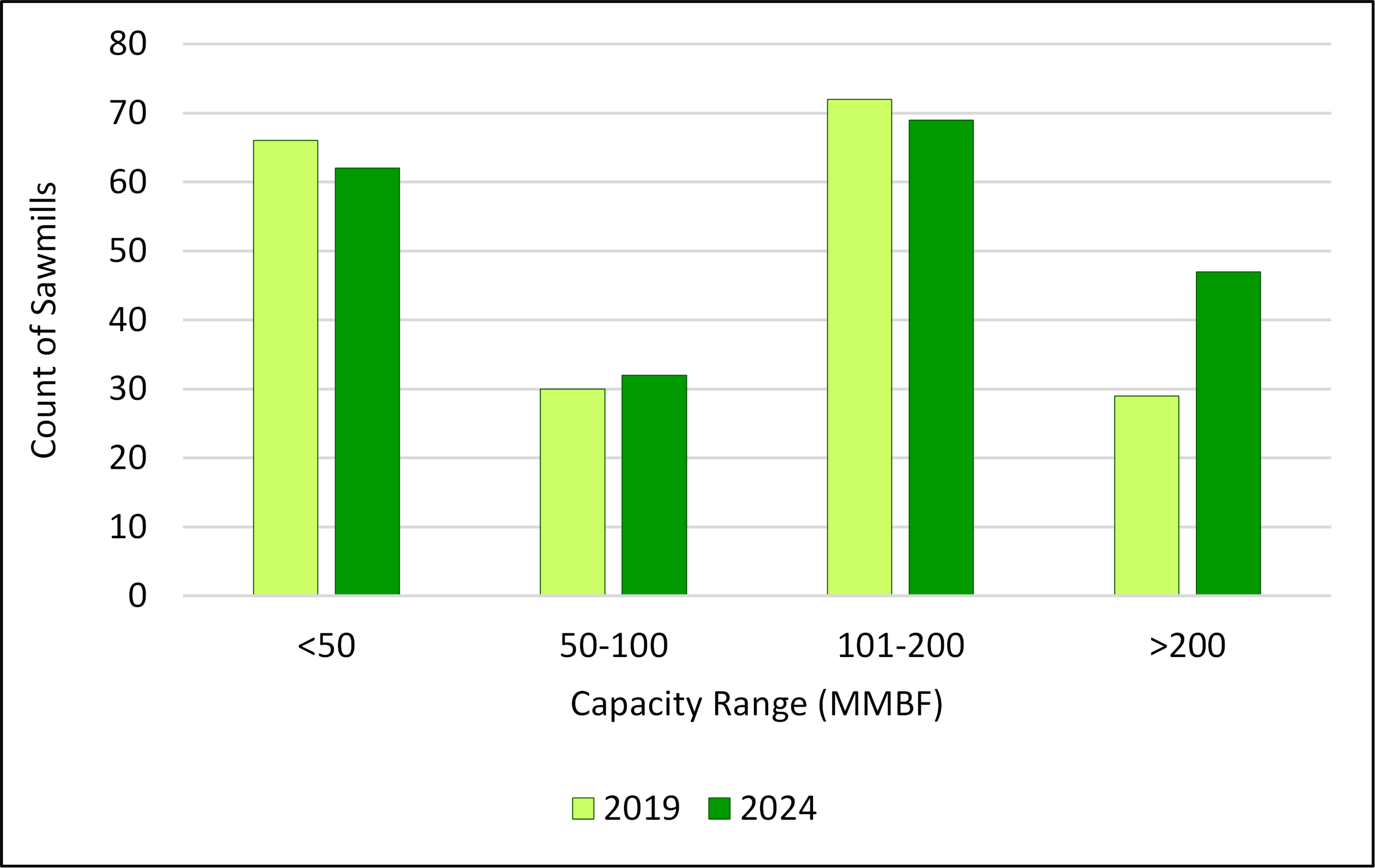

Since 2019, the number of southeastern mills with capacity less than 50 MMBF declined by 6%. Mills producing over 200 MMBF increased 62% over the same period. The average capacity of a southern sawmill increased as the number of larger mills grew.

Data Sources: Forisk

Capital allocation, log size, and end products contribute to production efficiency, influencing conversion rates and recovery factors. Since 2019, conversion rates have decreased likely due to capital investments and the exit of less efficient mills. In addition, a higher proportion of mills are above 200 MMBF, further increasing the recovery factor of the southern lumber industry.

This is great insight… Great work Thomas!