Review of 2024

The U.S. economy is currently on stable footing. Inflation remained close to 3% in 2024, down from its post-pandemic peak of over 7%. Unemployment rose only 3 tenths of a percentage point throughout 2024, remaining close to 4%. In response to growing signs of disinflation and an uptick in unemployment, the Federal Reserve lowered interest rates in the second half of 2024. However, the price of 30-year fixed home loans remains high at around 7%. Despite this disconnect between the Fed’s policy rate and mortgage rates, the housing sector proved resilient. Housing starts in 2024 totaled 1.364 million units (1.3% higher than Forisk’s year-end estimate and 0.7% lower than our Q1 2024 outlook), representing a 4% drop from 2023.

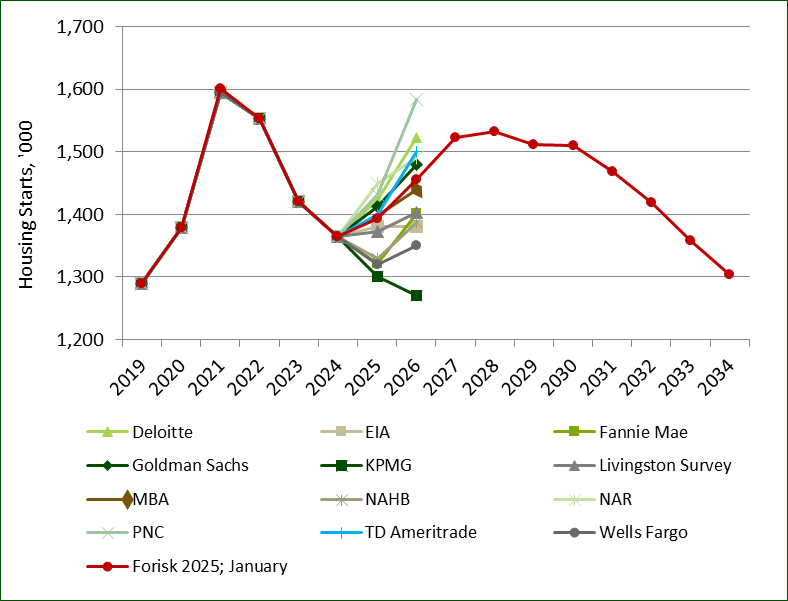

Revisions to the Near-Term Outlook

Forisk’s updated outlook for housing starts in 2025 and 2026 are 1.4% lower than last quarter. We now expect 1.393 million starts for 2025 and a 4% rise in 2026 to 1.455 million. While the revised outlook remains similar through 2030, our compilation of independent forecasts suggests a greater dispersion in housing expectations through 2026. Last quarter, we reported a range of 192 thousand units for the year-ahead forecasts in 2025. This quarter, the 2025 range in forecasts is 150 thousand units while the year-ahead range for 2026 is 313 thousand units. The larger spread between near term forecasts likely reflects a greater degree of uncertainty at the Fed over the appropriate policy rate in 2026 and greater uncertainty over economic policy more generally. Over the last 4 months, the economic policy uncertainty index spiked 47% over its average from Q1 2021 to Q3 of 2024.

Data Sources: Deloitte, EIA, Fannie Mae, Goldman Sachs, KPMG, Livingston Survey, Mortgage Bankers Association (MBA), National Association of Home Builders (NAHB), National Association of Realtors (NAR), PNC Bank, TD Ameritrade, Wells Fargo.

Risks to the Housing Sector Beyond 2030

Demographic shifts in the U.S. economy expose annual housing starts to specific variances beyond 2030. Independent reports published by the CBO and Harvard’s JCHS suggest that an aging population, declining birth rates, and lower rates of immigration contribute to lower annual rates of household formation. We now expect 8.6 million new households to form from 2025-2034 (down from the previous estimate of 11.3 million). After accounting for the second home ownership rate and the net replacement of existing homes, we project a demand for 14.5 million new units over the next 10 years.

The bequest of existing homes to younger households can lower the underlying demand for new housing units while lower rates of immigration have the potential to significantly impact the availability of labor in the housing construction sector. In 2023, 26% of the U.S. construction labor force was comprised of immigrant labor (its’ highest annual share since the American Community Survey began tracking labor statistics). Plastering, stucco masonry, drywall, roofing, and painting jobs may be most impacted, as more than 50% of the 2023 workforce for such jobs consisted of immigrant labor. About a third of the carpentry workforce in the U.S. is also foreign-born, where 65% of home builders have recently reported a labor shortage in the February 2024 HMI survey.

This post reports on Forisk’s Base case housing scenario for the Q1 2025 Forisk Research Quarterly (FRQ). To learn more or to subscribe to the FRQ, please contact Nick DiLuzio (ndiluzio@forisk.com).

Leave a Reply