This post includes data from Forisk’s North American Timberland Transactions Database and research from the Forisk Research Quarterly.

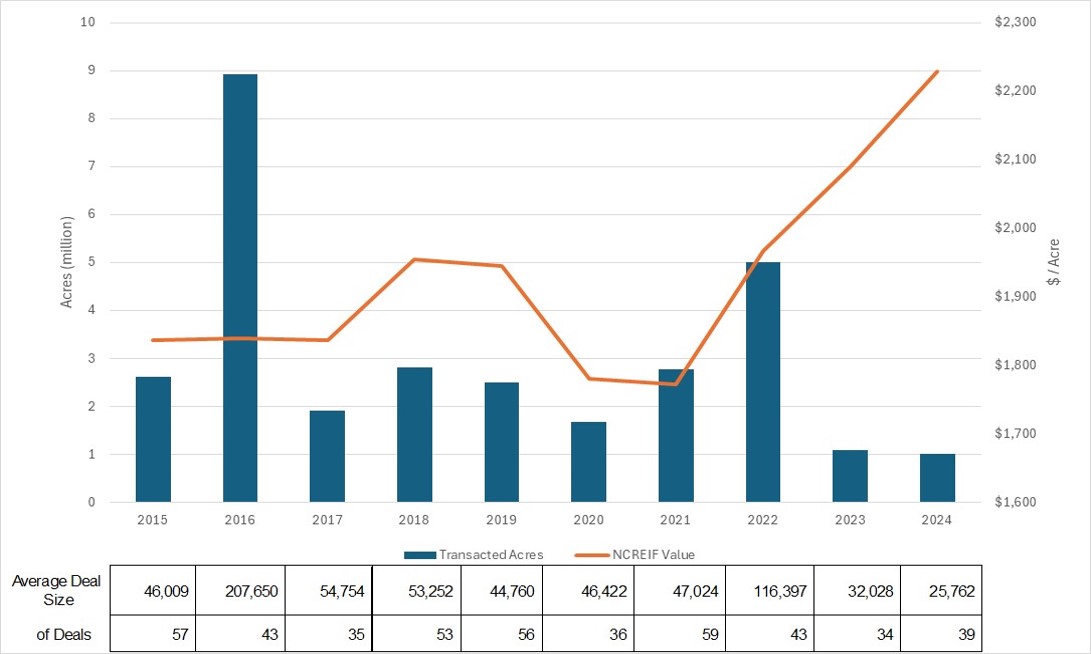

2024 was another below average year for U.S. timberland transactions. With about 1.0 million acres changing hands, 2024 fell in line with 2023 volumes well below the average of around 3.0 million acres traded per year in institutional or industrial transactions over the past 10 years. Meanwhile, the implied per acre valuation based on the NCREIF Timberland Index increased 26% since 2021. Combined with the 2024 election cycle and multiple policy announcements and reversals from the new administration to begin 2025, it seems political and economic uncertainty are causing many investors to take a wait and see approach, with potential sellers holding their highly valued assets while potential buyers wrestle with how to underwrite deals at current valuations.

The figure above shows total acres transacted by year from Forisk’s Timberland Transaction database along with the implied per acre value of private timberland from the NCREIF Timberland Index. The 2016 data includes 6.3 million acres from the Weyerhaeuser/Plum Creek merger, which distorts the normal trend. Also inflating normal annual acreage purchases in 2022 are The Forestland Group’s sale of 1.7 million acres to Blue Source Sustainable Forests (now Aurora Sustainable Lands) as well as The Ontario Teachers’ Pension’s redemption transaction of 870,000 acres from Resource Management Services. Without those large transactions, the 10-year average for total acreage would be 2.1 million acres, still well above the 2023 and 2024 volumes.

So, what can we infer from this data? Are we seeing a trend?

- For institutional investors, uncertainty equates to risk and there’s a lot of uncertainty in the market.

- Timberland is touted as a low-risk investment. If you already own timberland and it’s been performing well, why divest?

- Conversely, if you’re a buyer in the market, the recent rise in valuations adds additional risk when underwriting new acquisitions.

- The long-term nature of timberland investments and the relative scarcity of available assets leads to periods of low transaction volume.

There’s been no indication from industry sources or Forisk clients that there’s a lack of capital to invest. And we’re not seeing a rush to divest from timberland. It appears that, because we’re in uncertain times, Bid/Ask spreads have widened causing transaction volume to decrease. If the appeal of timberland is low volatility with a decent coupon from harvesting timber, it seems like it’s doing just that.

To learn more about the Forisk Research Quarterly (FRQ), click here or email Nick DiLuzio at ndiluzio@forisk.com.

Leave a Reply