This post is an excerpt from the Q4 2025 Forisk Wood Fiber Review (WFR), which provides a quarterly review of pulpwood, chips, biomass markets and trade in the U.S. and Canada.

With prices down and overall lumber markets soft in late 2025, several timberland owners and managers had largely finished their harvesting activities for the year as of October/November. The lower demand also made it “hard to move other species” like spruce or pine. “When markets are strong, the appetite at mills widens,” said one timberland manager. “They consider other specs and off species.”

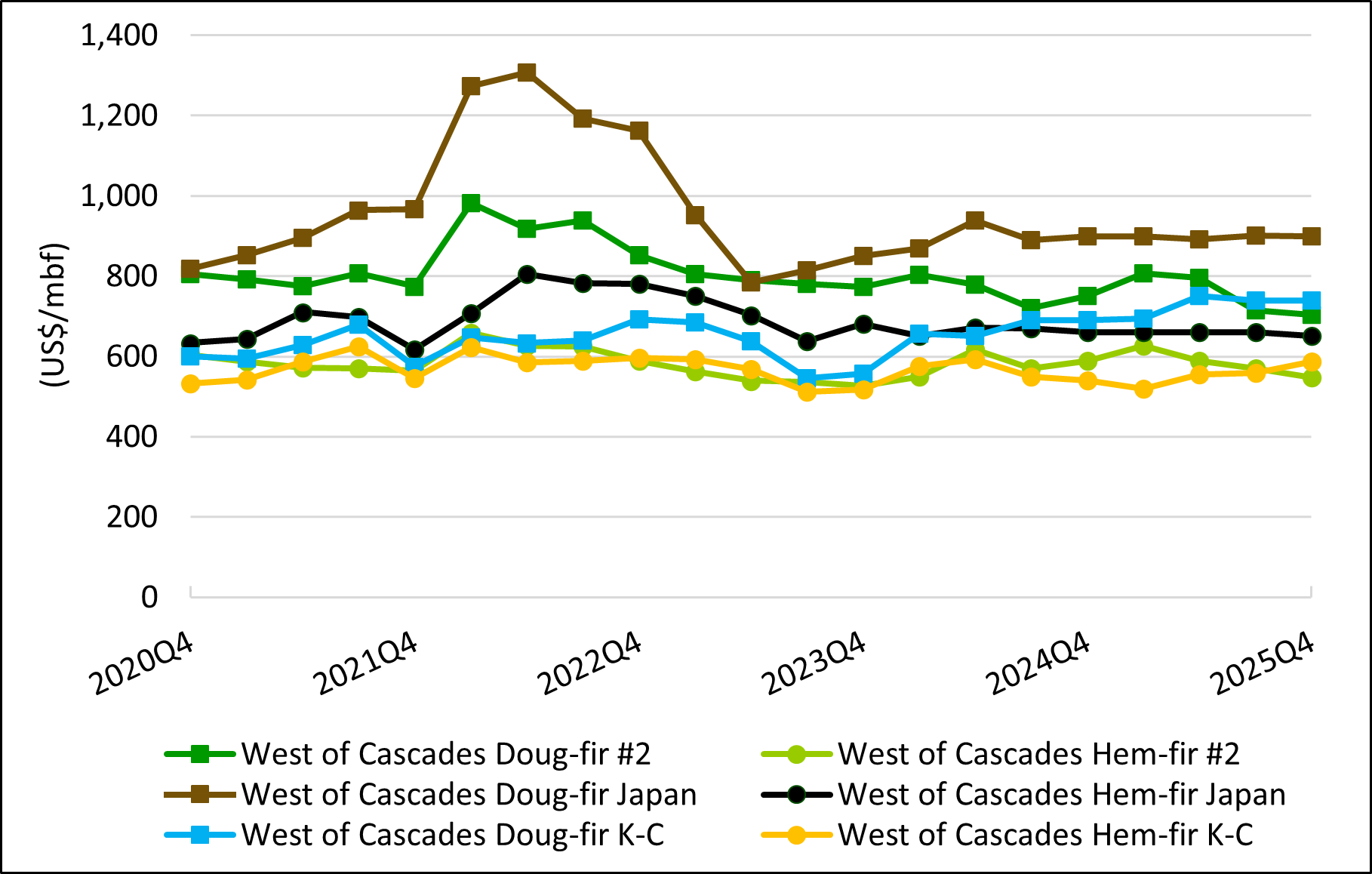

Timber sellers acknowledged strong log export prices to Japan. They expressed relief that the China log market had reopened, with buyers taking hemlock logs from the Pacific Northwest. “It will be good to get those wood flows again,” said one forestry consultant. Douglas-fir to Japan “is the best log out there” and “price holds if you have the quality,” with logs maintaining a $100+ per MBF premium over domestic #2 logs.

In the policy arena, Washington state’s new Department of Ecology rules (NP Rule) associated with non-fish-bearing perennial streams passed 7-5 in November. Recent analysis from the Washington Forest Protection Association (WFPA) indicated that the rule will take >200,000 private coastal timberland acres out of production.

Northwest Log Pricing Updates:

- #2 Douglas-fir and #2 hemlock logs saw decreases in delivered prices of -2% and -4%, respectively in Q4 2025. However, the modest quarterly declines understate the large, overall drop in domestic log prices in 2025.

- Douglas-fir was down over $100 per MBF since Q1 2025, and hemlock was down nearly $80 per MBF. Year-over-year, Douglas-fir and hemlock prices were down 6% and 7% since Q4 2024.

Data Source: Forisk Wood Fiber Review. All Prices in US$/mbf

Leave a Reply