This blog includes data from Forisk’s North American Mill Capacity Database, a database of over 2,300 wood-consuming mills in North America. For more information on the mill database or Forisk’s other products, please visit forisk.com or contact Nick DiLuzio at ndiluzio@forisk.com.

By Pat Jolley

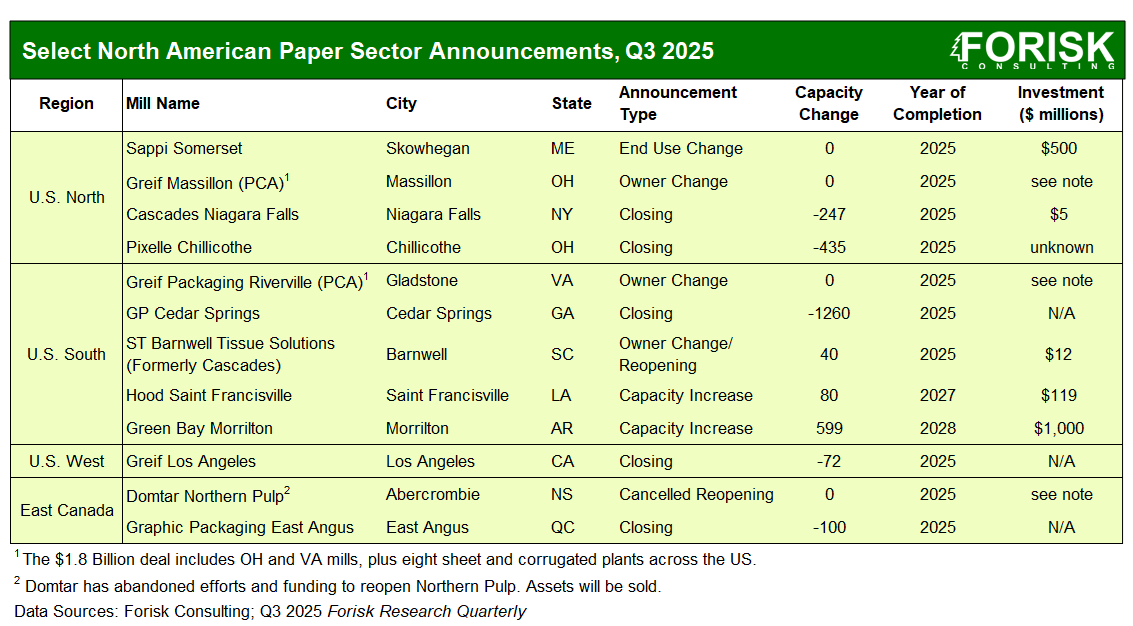

Capital investments are still being announced across North America’s pulp and paper industry. Expenditures totaling several billion dollars are in progress, despite notable closures announced in 2025. Some companies are shifting resources regionally, adjusting to market challenges and opportunities.

Georgia-Pacific completed the closure of its Cedar Springs, GA mill on August 1, 2025. Packaging Corporation of America is purchasing the containerboard business from Greif Packaging in a $1.8 billion deal. This sale includes mills in Massillon, OH and Gladstone, VA, along with eight sheet and corrugated mills across the U.S. Greif Packaging also closed its Los Angeles, CA mill over the summer. Cascades will close its Niagara Falls, NY facility permanently by September. ST Paper purchased a tissue mill in Barnwell, SC from Cascades and will reopen it in Q3 2025. Green Bay Packaging in Morrilton, AR has chosen a contractor for their $1 billion expansion which will include a new continuous digester, a new chip mill, and the addition of an onsite debarker and chipper. The investment could more than double the current pulping capacity at Morrilton. Also in the U.S., Sappi North America completed a $500 million investment at the Somerset mill in Skowhegan, ME, converting a paper machine from graphic paper to solid bleached packaging board. H.I.G. Capital closed the Pixelle Chillicothe, OH pulp mill on August 10, 2025. Hood Container announced $119 million two-phase modernization project at the paper mill in St. Francisville, LA to be completed over two years. Hood Container expects to significantly increase manufacturing capacity and feedstock purchases when the project is completed.

In Canada, Domtar has cancelled efforts to reopen Northern Pulp in Abercrombie, NS and the assets will be sold. Graphic Packaging announced that its East Angus, QC mill will close later this year when it reopens its new Waco, TX facility.

As of August 2025, Forisk tracks $6 billion dollars ($4.2 billion in the U.S. and $1.8 billion in Canada) in announced capital expenditures within the pulp and paper sector.

Leave a Reply