This post includes data from Forisk’s North American Timberland Transactions Database and research from the Forisk Research Quarterly. For more information about the Forisk Research Quarterly, please contact Nick DiLuzio (ndiluzio@forisk.com).

In Q1 and Q2 2025, Forisk tracked 22 completed timberland transactions totaling 258 thousand acres. This total excludes Weyerhaeuser’s announced acquisition of 117 thousand acres from Roseburg Forest Products (expected to close in Q3) and Soterra’s sale of 176 thousand acres to Molpus Woodlands Group (expected to close by year end). 2023 and 2024 totals were just over a 1.0 million acres and 2025 looks like it will fall in line with that trend.

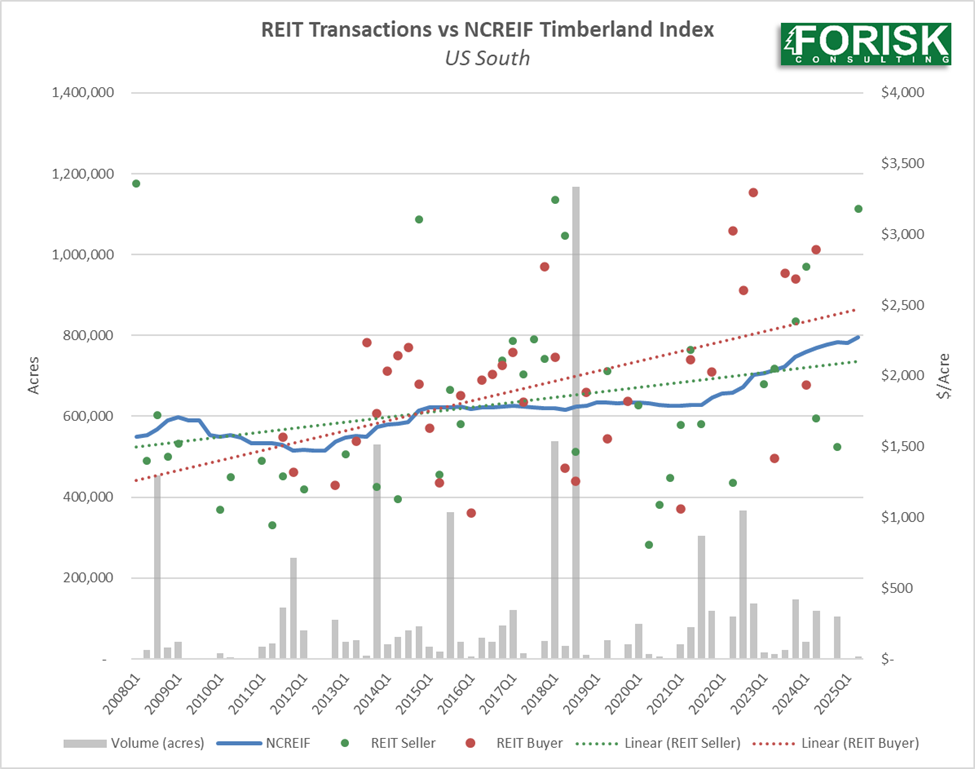

In recent posts we’ve discussed the slowdown in transaction volume over the past couple of years in relation to the increasing NCREIF valuations. In our Q3 2025 feature article from the Forisk Research Quarterly we explored the differences in public market (Timber REIT) valuation versus private market (NCREIF) valuations. Here we extend our analysis of public vs. private market valuations.

Because the Timber REITs hold non-timberland assets and have different ways of reporting financial information related to their business segments, it can be difficult to estimate the value of their timberlands. For this analysis we looked at actual transaction data from the Forisk Timberland Transactions Database to see how those lined up with NCREIF valuations.

We queried the database for transactions involving Timber REITs as buyer or seller. We included existing Timber REITs (Weyerhaeuser, PotlatchDeltic, Rayonier) as well as Plum Creek and Catchmark Timber. We considered whether the REIT was a buyer or seller and for transactions in which both buyer and seller were Timber REITs, we included the transaction in both categories.

The following figure shows the per acre transaction values, by quarter, for Timber REIT transactions as buyer or seller. We focused on the US South as there were the most transactions, and it mirrors NCREIF’s regional reporting.

Trendlines over time suggest that timberland values of the Timber REITs track nicely with the NCREIF Timberland Index. It is interesting to note differences in REIT acquisitions vs. divestitures over time. The trend might suggest a rebalancing of portfolios, selling off underperforming assets while focusing on acquiring higher quality timberlands.

Leave a Reply